SolarReserve this month issued bids in Chile’s latest auction for 24-hour solar under 5 cents per kWh

SolarReserve this month issued bids in Chile’s latest auction for 24-hour solar under 5 cents per kWh, according to CEO Kevin Smith in a release posted on Twitter, Saturday.

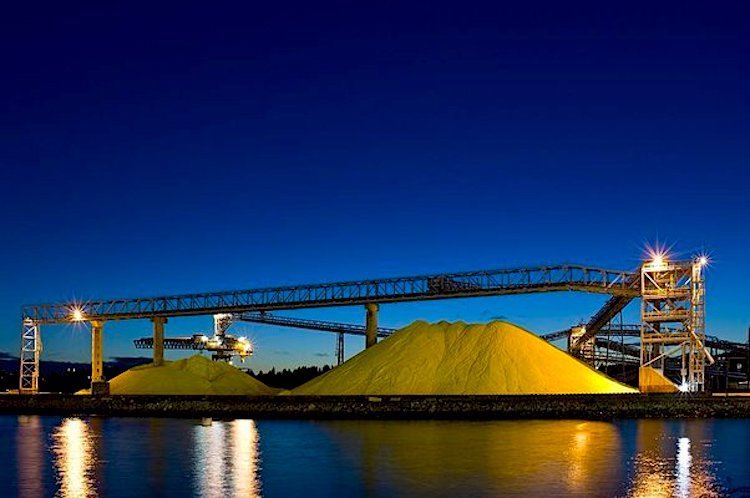

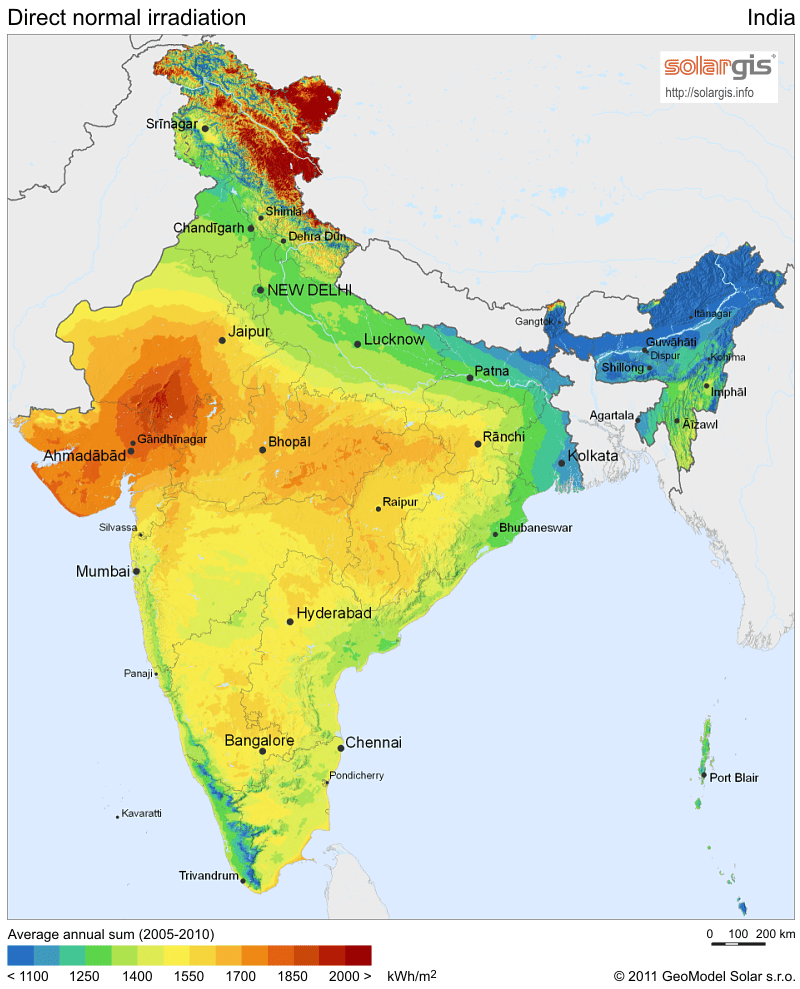

“Irradiation levels in the Atacama Desert in northern Chile are “off the charts,” Smith said. “That obviously helps.” SolarReserve is developing several projects in the region, including its fully permitted 450-MW Tamarugal and 260-MW Copiapó facilities. The 390-MW Likana project also is in development.

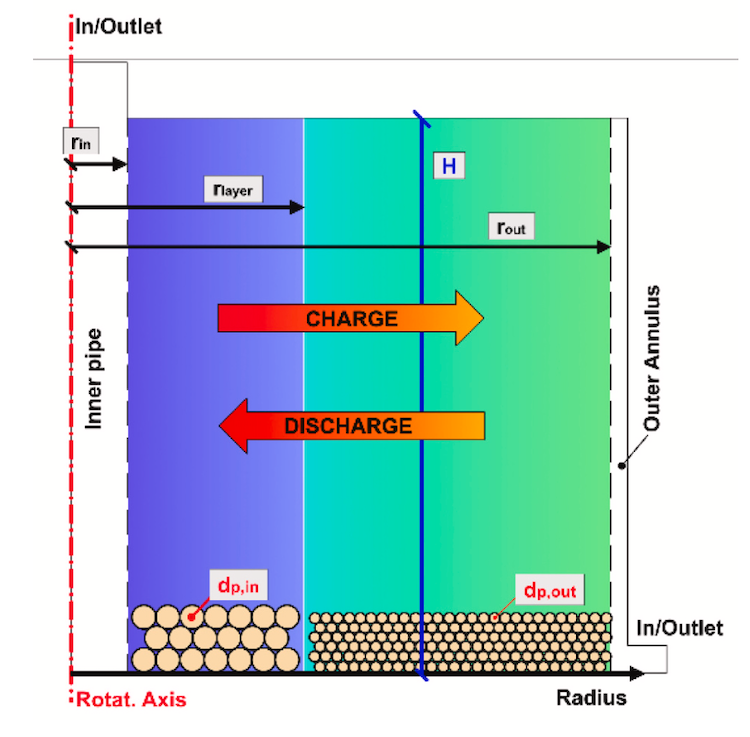

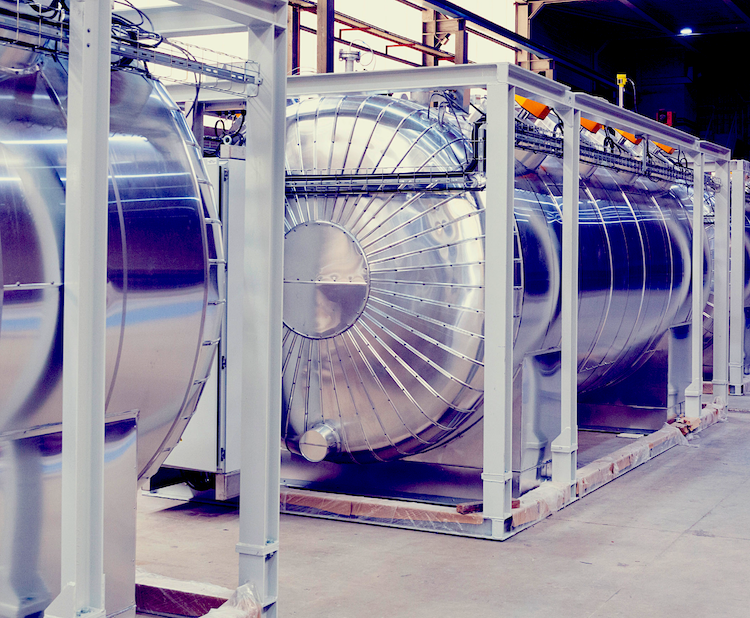

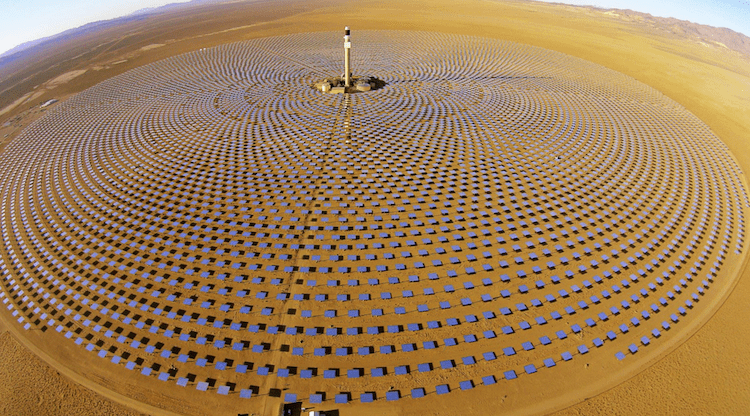

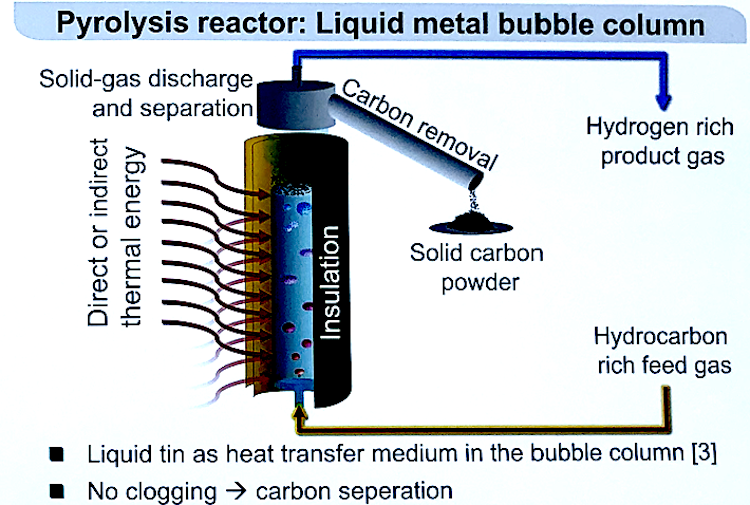

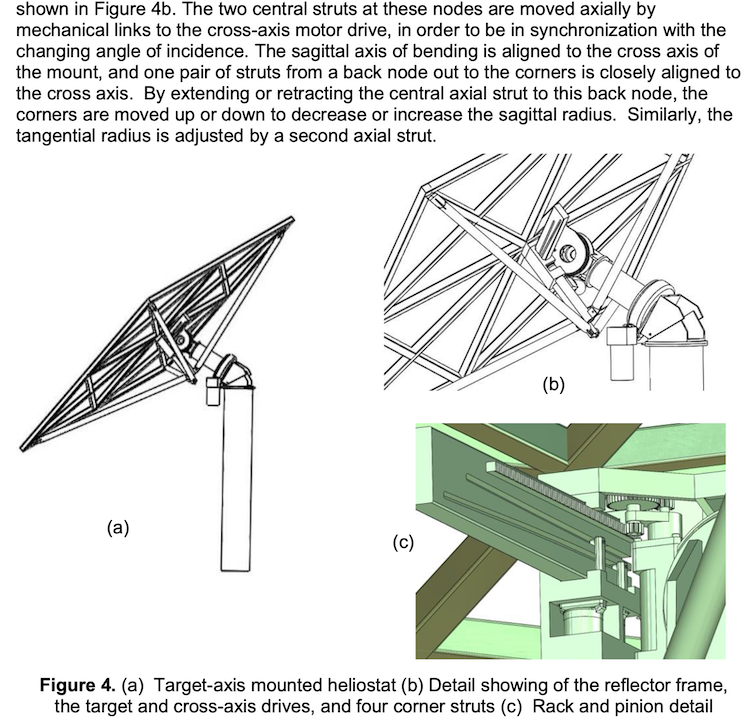

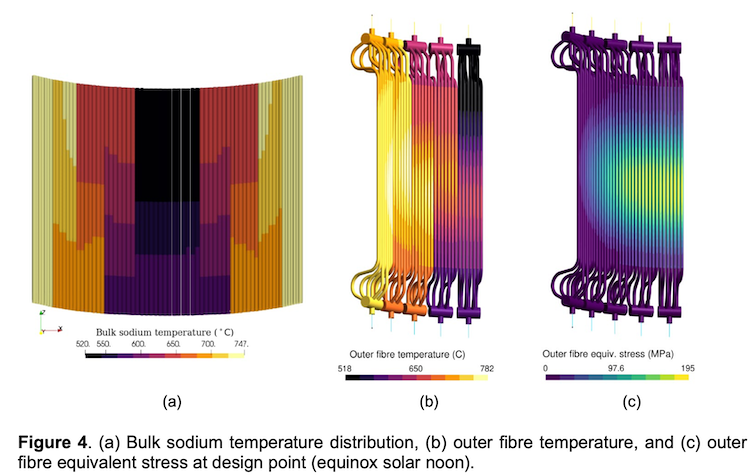

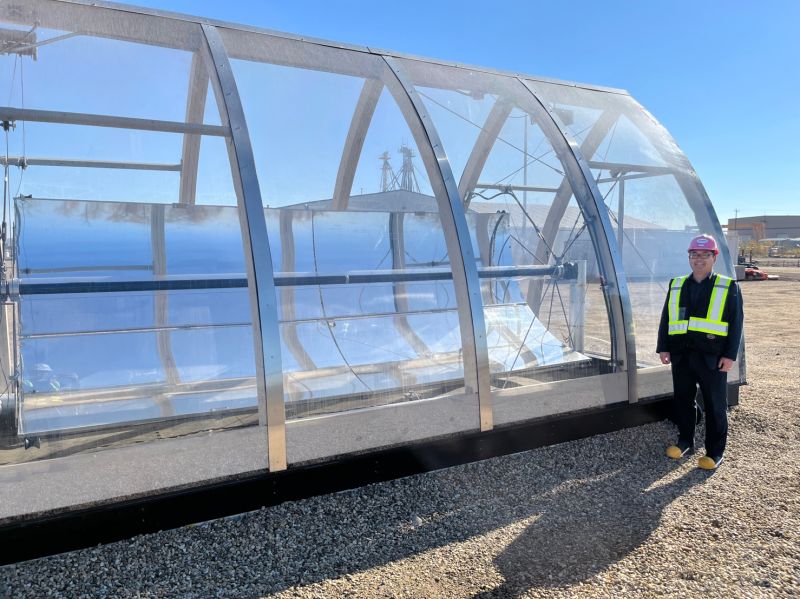

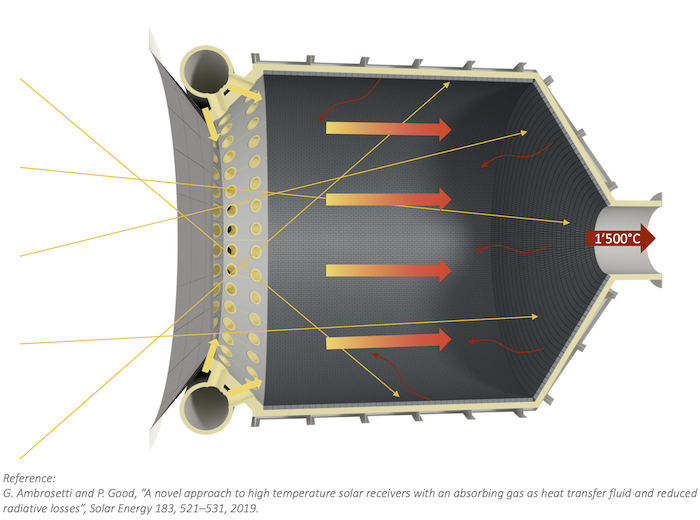

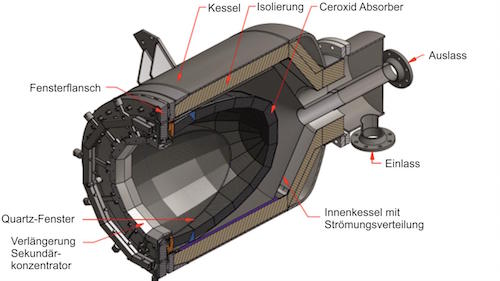

Equipped with 13 hours of storage each, SolarReserve’s Chilean power towers are designed as baseload plants. Like Crescent Dunes, they would rely on thousands of sun-tracking mirrors to aim concentrated sunlight at a heat exchanger, or receiver, sitting atop a tower hundreds of feet high, where molten salt is heated to create steam for a turbine. Unlike many rival towers, including those at BrightSource Energy Inc.’s Ivanpah complex in California, SolarReserve uses liquid salt, rather than water, as its operating fluid and its thermal storage medium.

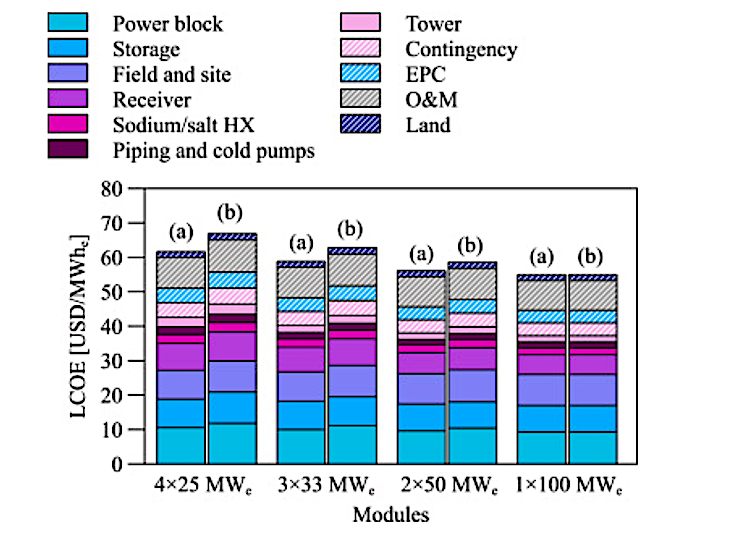

U.S. goal: 24/7 solar at 6¢/kWh to 8¢/kWh

Given the challenges the California ISO is experiencing with intermittent solar, Smith believes there’s a new opportunity for CSP. “The need for storage is a lot more acute than it was five years ago,” the CEO said. “Theoretically, utilities will have to solve the ‘duck curve’ problem … If that means they have to buy 7-cent [baseload solar] instead of 3-cent intermittent wind or PV, then they will have to do that.”

While SolarReserve does not believe it can replicate its Chilean bids in the U.S., it plans to slash prices by about half from a few years ago. “The goal for our technology is in the 6- to 8-cent a kWh range,” Smith said. “That’s the range we are looking at to provide dispatchable solar that can operate 24 hours a day.”

The developer is in early permitting for its 2,000MW Sandstone project, which would feature up to 10 towers on federal land in Nye County, Nev., to market around-the-clock solar power to utilities in California. “If California is going to get from 30% [renewable electricity] to 50%, it’s going to need storage,” Smith said, and not just the shorter-term variety offered by batteries. The company hopes to secure a contract and financing to start construction on the first phase of Sandstone in the next two to three years.

In seeking to re-enter its home market, SolarReserve may have an important ally in the federal government. The U.S. Department of Energy in September announced $62 million to fund applied research and development to enable CSP to generate electricity at 6 cents per kWh or less.

SolarReserve does not believe a recent hiccup at its Crescent Dunes plant will complicate its aspirations. While the core receiver technology “has been operating quite well,” Smith said, the company last fall discovered a leak in a molten salt tank caused by a construction defect. That triggered an eight-month outage. The plant is now back in operation.

Some analysts see a bright future for the technology. “CSP has seen impressive cost reductions in recent years and is poised for growth,” found a recent report from the International Renewable Energy Agency. The agency estimates between 45,000 MW and 385,000 MW of CSP could be installed globally by 2030. That compares with 4,906 MW in operation today, with another 4,287 MW under construction or in near-term development, according to SolarPACES.”

Source: https://marketintelligence.spglobal.com/our-thinking/news/advancing-abroad-solarreserve-plots-power-tower-comeback-in-southwest