The Department of Energy’s (DOE) Loan Programs Office (LPO) provides access to debt capital for high-impact energy and manufacturing projects. Over more than a decade, LPO has developed a strong understanding of what makes a project more likely to advance through LPO’s processes, as well as the areas that commonly slow down or stop projects in the process. The following tips suggest best practices for considering whether LPO financing could be the right choice and what to include or what to avoid when applying to work with LPO.

For additional details about these areas and many others, please refer to the Getting to Know LPO blog series. You may also want to learn more about the types of projects in LPO’s portfolio, as well as the types of projects that are in LPO’s pipeline. If you believe your project could be the right fit for a DOE loan or loan guarantee, submit an online request for a pre-application consultation.

FINANCIAL

Is our project big enough, and how much debt financing is typical for a project?

LPO was created to provide debt capital for high-impact projects that are unable to access adequate amounts of capital from private debt markets, if they are even able to access debt capital at all. Due to the way that LPO programs are funded, there are expenses associated with obtaining an LPO loan that average several million per application. While there is no statutory lower limit on the size of a loan that LPO can provide, they become less attractive for borrowers under ~$100 million.

For reference, the average loan requests at LPO are nearly $1 billion, and the smallest loan requests are around $100 million.

Do we have a reasonable strategy for selling what we will be producing?

While LPO can underwrite some level of merchant risk, the nature of project financing is that certainty of project cash flows is optimal. Every LPO loan must have a reasonable prospect of repayment, which is largely determined by the certainty and quality of payments from customers and generally need to be obtained prior to a loan being issued. Ideally, LPO looks for signed offtake contracts or committed letters of intent for a significant portion of each project. Sometimes, loan tenors can be longer than the length of offtake contracts.Given the unique nature of manufacturing in the transportation sector, LPO has provided specific guidance for the Advanced Technology Vehicles Manufacturing (ATVM) Loan Program. LPO will evaluate whether the applicant will be able to achieve sufficient sales of its products to sustain long-term existence. Based on past experience, certain measures observed by DOE provide a higher level of confidence in future sales to be achieved in the absence of a demonstrated sales history. For example, long-term purchase contracts from creditworthy offtakers (contracted offtake) can significantly reduce market risk. Commitment from an established “anchor tenant” to purchase the project output can signal a higher likelihood of project viability to LPO. Similarly, if the market for a product is an established “commodity market,” characterized by standardized performance requirements and widespread demand, evidence that the applicant will be able to sell into that market profitably may serve to mitigate market risk.

Have we raised development capital, and do we have committed project equity?

The various elements of developing a commercial-scale energy infrastructure or manufacturing project—such as pre-FEED (front-end engineering and design) studies, Front-end Loading (FEL)-2’s, permitting, analyses, financial advisors, and legal counsel—all require significant capital. Successful applicants have this capital in place when they begin the application process, and they almost always have several of these pieces in place. Further, FEED studies help to ensure that major design decisions are viable before construction begins. LPO’s Outreach and Business Development team welcomes pre-application consultations prior to having all these pieces in place. However, the most productive consultations occur when prospective applicants can share the status of their project development activities.Applicants should expect to have 30–50% of their total capital needs met with equity dollars that are committed at the project level, and they will need to show early in the application process that they have this equity in place or have a clear path to obtaining it. While LPO can lend up to 80% of eligible project costs by statute, a 50–70% loan-to-value is more typical in the office’s portfolio. The lower loan-to-value figures are based on several factors, including the ability to adequately service debt. LPO looks favorably on cash equity, but in some cases could consider in-kind contributions and property, depending on transaction-specific factors. Equity may not include proceeds from another loan nor the value of any federal, state, or local government assistance or support or any cost-share requirements under a federal award. Subordinated debt or state grants may contribute to equity if the sponsor contributes a significant amount of cash (usually 20% of project costs but can be lower for larger projects).

TECHNICAL AND ENVIRONMENTAL

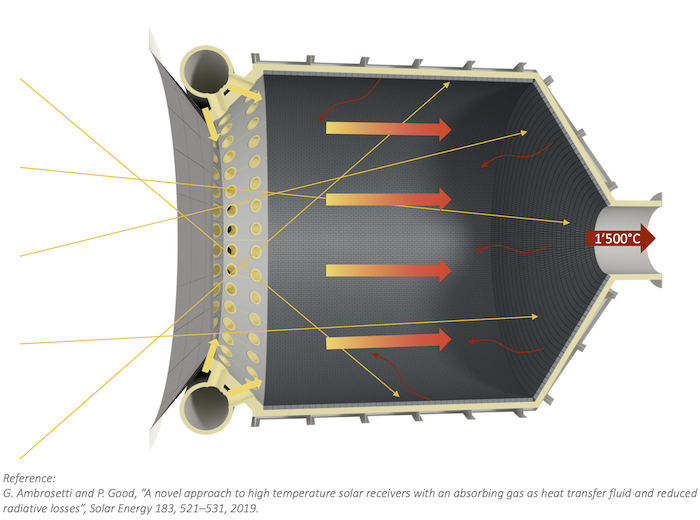

Do we need a successful demonstration or pilot for our project?

One of the unique values that LPO offers is its team of engineers, backed by the scientific expertise across DOE and the National Labs. When considering an Innovative Energy or Innovative Supply Chain project under the Title 17 Clean Energy Financing Project, LPO’s engineers generally look for 1,000–2,000 hours of demonstration or pilot plant operations that successfully prove the technology being commercialized will work as intended and designed. LPO also likes to see at least one, but preferably two or more, operations & maintenance cycles to demonstrate that the prospective borrower understands what it will take to maintain the facility/process being financed. Applicants will be asked to provide this data.LPO also offers loan products for projects that use already commercially-deployed technologies—State Energy Financing Institution projects, Energy Infrastructure Reinvestment projects, ATVM projects, and Tribal Energy projects. LPO will evaluate the project’s technology in due diligence similarly to how a private lender would.

Has our project been designed and engineered, and is it commercially ready for construction and operations?

Most successful applicants begin the application process with a completed FEED or pre-FEED study. During due diligence, LPO will contract an independent engineering firm (paid for by the applicant) to produce an Owner’s Engineer Report to independently assess the project and identify technical risks that could impact loan repayment. LPO will also look for signed engineering, procurement, and construction (EPC) contracts to demonstrate that the project is feasible and ready to be built. LPO looks favorably upon full-wrap EPC contracts and will evaluate the capabilities of the applicant and its EPC contractors to construct and start up the project during application review. Projects are typically Technology Readiness Level 8 and above.

What level of environmental review do we need?

The scope of an applicant’s project that is the subject of the request for a loan or loan guarantee determines the extent of the environmental review pursuant to National Environmental Policy Act (NEPA) and the associated regulatory agency consultations that are required of federal agencies (e.g., reviews and consultations pursuant to the Endangered Species Act and the National Historic Preservation Act). The NEPA process is a forward-looking process that allows federal agencies to study the environmental effects of the applicant’s proposed actions and reasonable alternatives. Therefore, an applicant should factor in time in its anticipated construction schedule to allow LPO, in coordination with the applicant, to complete the NEPA review process prior to the start of construction—this could include a request for LPO to start the NEPA early in the process.Specifically, the scope of the environmental review is based on the activities associated with construction, including initial site development, startup, and commissioning activities that are the subject of the loan or loan guarantee request, as well as activities associated with the operation and, in some cases, decommissioning. Therefore, a key step in LPO’s environmental review process is to assess the condition of the project site and complete any required biological or archaeological surveys prior to any construction or site development activities. The established baseline condition forms the basis for the NEPA review, as well as for any regulatory agency consultations required by federal agencies. If considering LPO financing, LPO recommends potential applicants contact the office to discuss the application process and timelines before initiating construction or site development activities. This sounds complicated but we can help you through it—just ask.Click here to learn more about how to engage with LPO on NEPA.

Do we have site control and necessary regulatory approvals?

Successful applicants own their project site or have signed a lease agreement that gives them full control of their site. They have also obtained (or are in the process of obtaining) all necessary federal, state, and local permits and authorizations to site, construct, operate the project, and, if necessary, to connect to the electric grid. Prospective applicants can engage in pre-application consultations prior to obtaining site control and all permits; however, the most productive conversations occur when the prospective applicants can describe its status in identifying and securing a site and its permits, as well as the required zoning designation to operate. Having the necessary regulatory approvals to show your project is ready to build demonstrates commercial readiness.

Do we have an experienced management team that has successfully built projects before?

A quality and experienced management team lowers the risk of a project because leaders have the capability to solve the inevitable challenges that arise when building large, innovative energy projects. LPO looks strongly upon management teams that have experience in developing, financing, and executing large infrastructure projects.

COMMUNITY AND CLIMATE BENEFITS

Can we demonstrate the emissions benefits of the project?

Every project receiving Title 17 financing must achieve significant and credible greenhouse gas (GHG) and/or air pollution avoidance, reduction, utilization, or sequestration. Successful applicants may provide data to LPO demonstrating their emissions benefit relative to a business-as-usual case. LPO’s Technical and Environmental Division will perform a full life cycle analysis of the project in the Part I application review to determine project eligibility. Projects that have already run an analysis may submit this data as ancillary information, but the GHG analysis performed by LPO is the final and only determination for Title 17 eligibility.The ATVM Loan Program provides financing to establish, expand, or re-equip manufacturing facilities for eligible light-, medium-, and heavy-duty on-road vehicles, characterized by minimum fuel economy improvements. Eligible manufacturing facilities also include those that produce qualifying components and materials that are designed for and installed into ATVs for the purpose of meeting their performance requirements. The Bipartisan Infrastructure Law and Inflation Reduction Act have expanded the ATVM program’s authority to include manufacturing facilities for locomotives, maritime vessels, aviation, and hyperloop; program guidance for these categories is currently in development.For Tribal Energy projects, the project must be wholly or substantially owned by an eligible Tribe, including an Alaska Native village or regional or village corporation, or a Tribal Economic Development Organization. For a project that is less than wholly owned by an eligible borrower, LPO may consider the project if it determines there is a measurable benefit to an Indian Tribe, whether by (a) location on Indian lands, (b) provision of energy services to Indian lands, or (c) integration with Indian energy resources (or otherwise, support for the proposed ownership structure).

Have we considered how the project will benefit the local community?

Successful applicants for any of LPO’s programs must submit a Community Benefits Plan (CBP) that explains how the proposed project will support (a) community and labor engagement; (b) quality jobs; (c) diversity, equity, inclusion, and accessibility; and (d) environmental justice (as addressed through the Biden-Harris Administration’s Justice40 Initiative). Developing a CBP is a recognition that choosing a community is a multi-decade commitment to a positive impact on the lives of a project’s community members. Collaborating with partners, such as local governments and labor unions, can help build institutional support and secure a skilled, high-quality workforce throughout the life of a project.

Click here to learn more about how to get started on your CBP. To view all LPO projects, visit the project map.