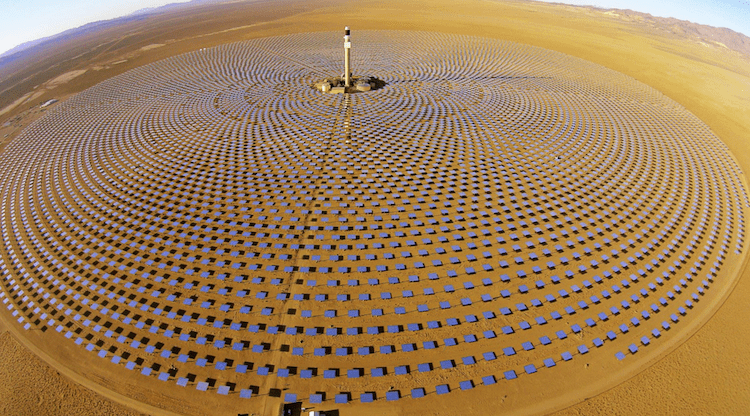

NurEnergie just applied for the permit to build and export desert solar power to Europe from a gigantic 4.5 GW concentrated solar power (CSP) project with thermal energy storage at an expected price of 10 cents/kWh.

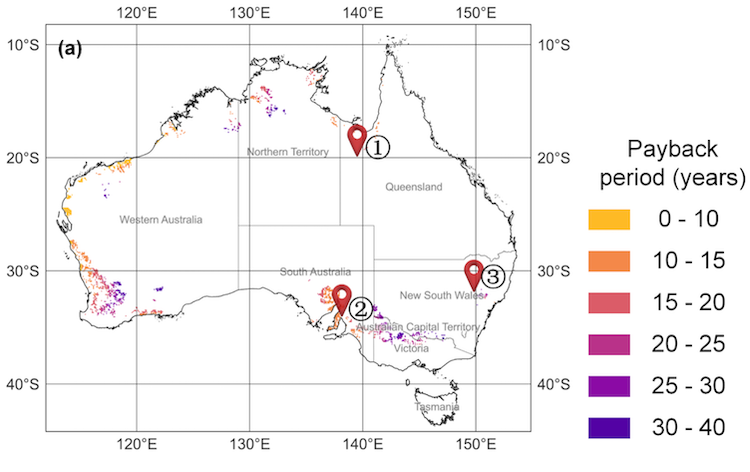

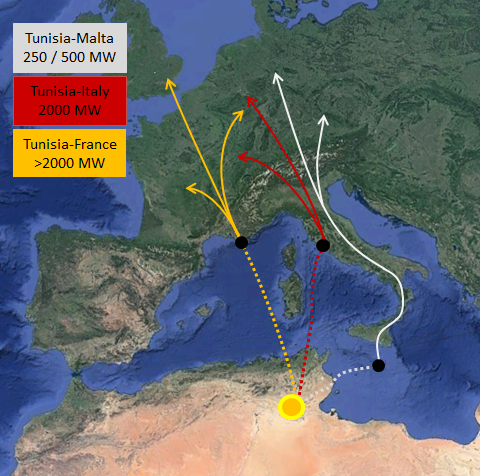

NurEnergie’s TuNur project, located near Réjim Maâtoug in Tunisia, would phase in over three stages, with an initial first 250 MW CSP project to cover Malta’s entire renewable needs by 2020, the second to supply up to 2 GW of CSP to central Europe, and a third to supply a bit under 2 GW, landing directly in France at Marseille.

SolarPACES spoke via Skype this week with TuNur CEO, Kevin Sara, who is realizing the Desertec vision of exporting round-the-clock solar thermal energy from the deserts of North Africa to Europe.

SK: Sending power to Europe from North Africa: has anything like this been done before?

KS: It’s important to understand that today Europe is actually importing about 60% of its primary energy; mostly through gas pipelines – and through LNG tankers – as oil and gas. So, Europe already imports energy. But it’s mostly fossil fuel – via pipelines.

And it’s mostly from Russia and that’s increasing but we don’t like to talk about that. You may have heard about the Nord Stream pipeline, it’s very controversial. Russia is expanding those and Germany and the European commission is questioning the prudence of over-reliance on Russia for energy supplies. And there is also talk of yet another gas pipeline between Algeria and Italy.

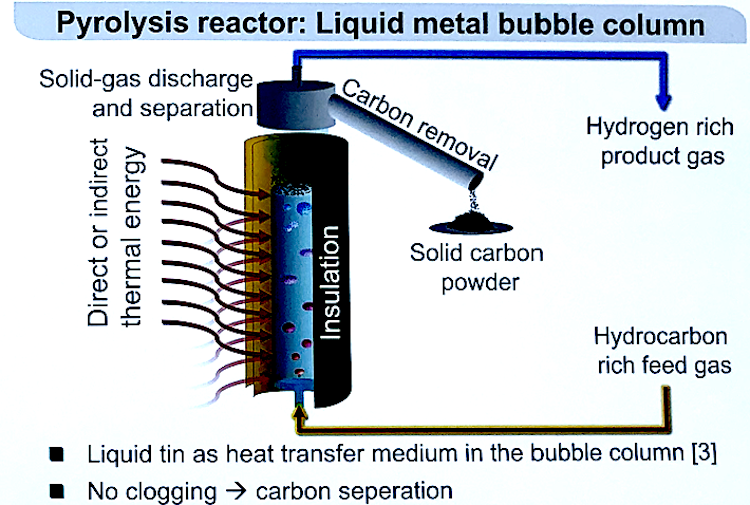

And natural gas is what competes with CSP.

Europe already imports energy a longer distance: via natural gas pipelines from Russia

Europe already imports energy a longer distance: via natural gas pipelines from Russia

SK: So I guess the fossil lobby is strong in Europe.

KS: Our biggest fight is the fossil fuel industry lobby. It is extremely well-funded. They know how to work the political class. They’ve convinced many politicians that the solution to climate change is converting coal power plants to gas. But gas has still got a huge carbon footprint. So it is not a long-term solution.

We’re saying; these are not the kind of projects you should be investing in because they are fifty-year infrastructure and 50 years from now according to your plans you shouldn’t be using fossil fuels gas and oil. You should logically have switched over to renewables. You should be investing in fifty-year infrastructure for importing renewable energy; HVDC cables, not gas pipelines.

SK: Yet some people are defecting from dirty energy: I see that one of your Tunisian investors; the TuNur Director and shareholder Cherif Ben Khelifa is a former oil industry executive.

It’s ironic that the people who have the most knowledge about executing large energy projects in this world are from the fossil fuel sector.

Yes, he developed a lot of the big fossil fuel projects for big companies like Total and Shell, essentially he developed the offshore oil industry for Tunisia.

But he was interested in his legacy; in doing something in the renewable sector, and he had the experience of doing large projects, and most of all he had the experience in getting projects realized within the Tunisian context; negotiating with the authorities and making sure that the local people were happy.

So he has both the experience of large infrastructure, but also offshore oil platforms are linked with submarine cables for electricity, so for him the whole aspect of the project linking by cable to Europe was not daunting in the least and a lot of it is been done by Tunisian subcontractors.

The three stages of TuNur’s 4.5 GW plan to export CSP from Tunisia to the EU. The dotted lines represent the new HVDC cable routes.

SK: What about the technical challenge of sending power so far via undersea cables to Europe?

It’s not that much of a distance. It is very similar to the big offshore wind projects.

I’m not the least bit concerned about the technology. Because there’s so much experience in building submarine infrastructure under the Mediterranean: it is crisscrossed with telecom cables already. There are major gas pipelines crossing the Mediterranean at several points. The industry really masters the submarine world: a lot of it is because of the offshore oil and gas experience and now the offshore wind industry so this is a very experienced technically can-do industry sector. And there is a lot of competition as well. So we are not concerned about that aspect of it.

SK: HVDC loses what maybe 4% over a thousand kilometers and up the whole of Italy is only 1,200 km.

KS: HVDC losses are really quite low and that’s why you have these huge power projects like in Brazil, the power to Sao Paulo 6,000 kilometers away and in China you have like the Three Gorges Dam which is powering coastal cities thousands and thousands of kilometers away. It is economically viable and they have very low losses.

SK: Why does your cable to France go just underwater rather than dropping off in Sardinia to supply some Sardinian power?

KS: Ironically it’s easier just to keep the cables in the water. For permitting.

Plus, there’s something about the energy biz that it does bring out a certain kind of nationalism. Countries don’t trust other countries to transit energy and they feel most comfortable if the pipes land right into their territory, so we think France will prefer cabling landing directly from North Africa into French territory.

Sardinia just built two years ago a very large capacity cable linking Sardinia to mainland Italy near Naples. I think that’s actually the deepest submarine cable for power in the world. It goes down to over 1.6 km in depth.

When they made that cable we realized that our project is technically possible too. Because between Tunisia and Malta is also very deep. The second phase is very deep as well.

SK: I hear Malta’s not meeting its EU climate requirement.What is Malta’s load? Might this one project enable it to meet its entire commitment? When could that be delivering by?

KS: The first 250 MW phase, with a connection to Malta, could be running by 2020. We estimate €1.6 billion.

Malta’s load in 2014 was 2,245 GWh, and their renewable energy target is 10% by 2020 – it was at 5% in 2015 – which would be 225 GWh. This could be entirely supplied by TuNur.

SK: I see your background is renewable energy consulting at McKinsey&Co. As a relative newcomer, will you work with experienced CSP “old hands”?

KS: Yes, I was with McKinsey, but I’m really more of a doer rather than a thinker. We had joined Desertec, which was more of a study group, but we saw that with so many shareholders it was going in too many different directions. We are really a project development company.

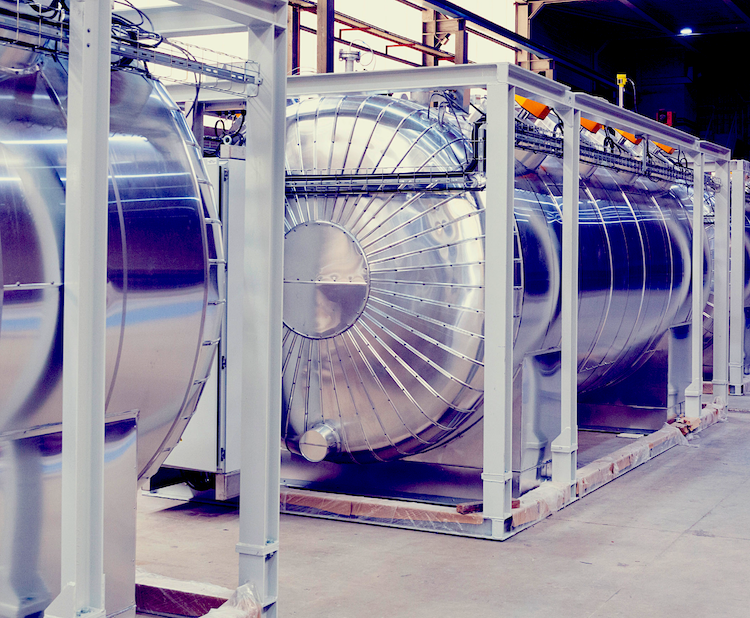

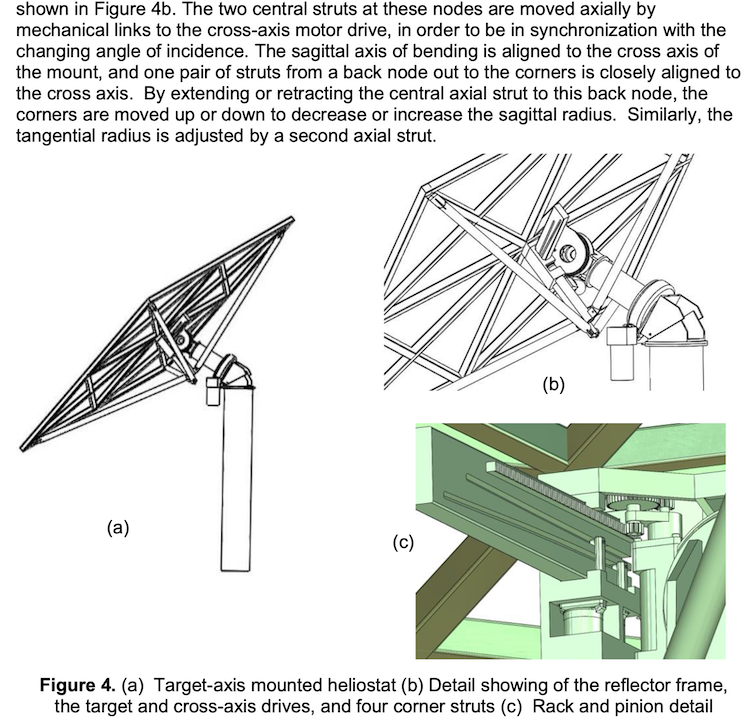

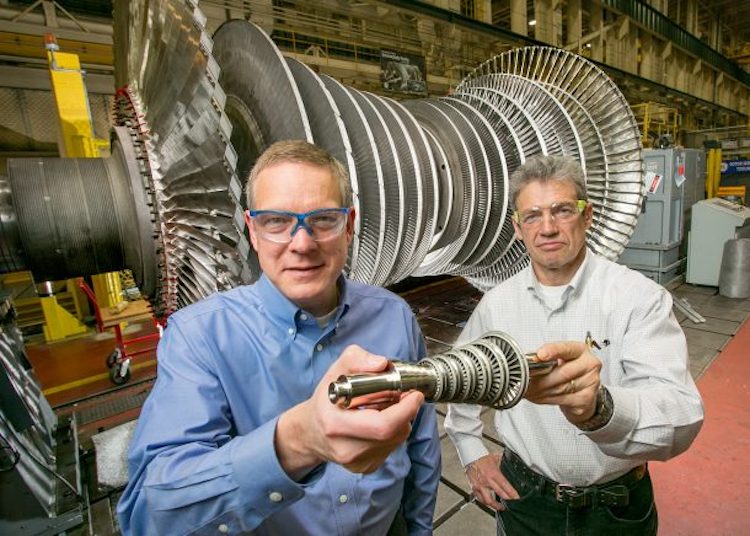

Nur Energie has worked very closely with some of the leading technical service providers in the industry including BrightSource energy, which has provided high level design services, and Frank Dinter, for ongoing consulting. Nur Energie and TuNur work with highly specialized technical consultants including CSP Services GmbH which has been in charge of the verification of the data collection on site.

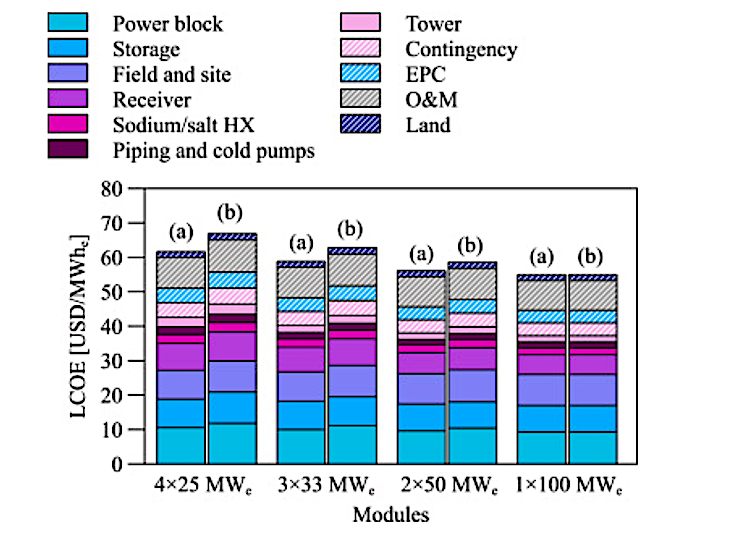

SK: You plan to sell at just 10 cents/kWh, comparable with the 9.4 cents Dubai bids in May. But your 50 MW MINOS CSP tower project in Crete is a lot more expensive; 33 cents. Why was Crete so much more?

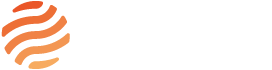

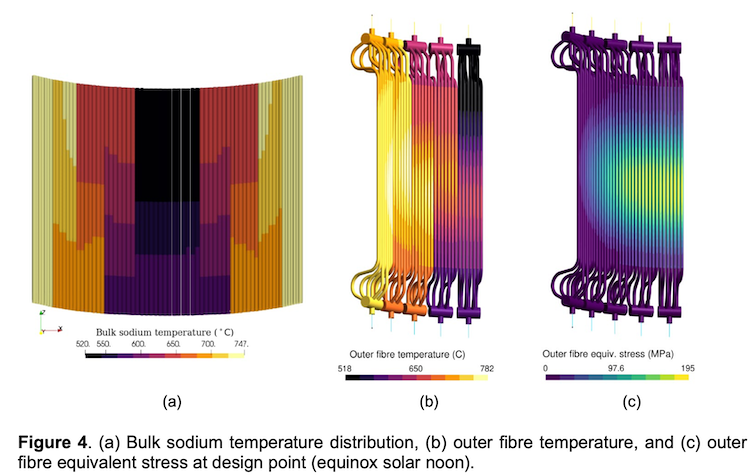

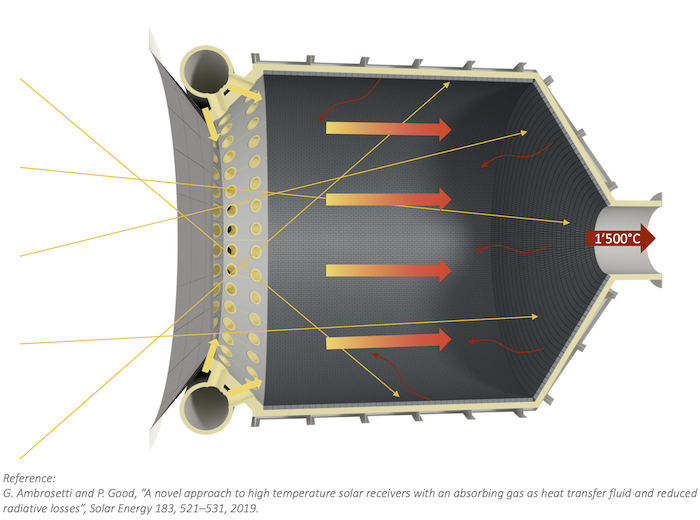

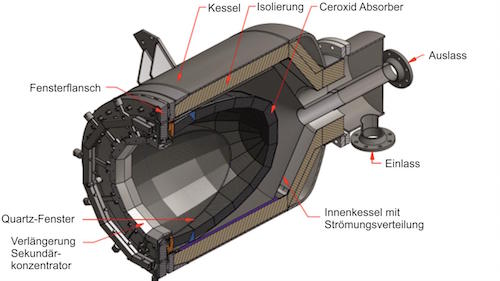

KS: Well, Crete is a special project. It is a innovative CSP plant which has got a double tower and so for that reason it enjoys a higher tariff. So it receives a subsidy from the European commission as a new CSP technology. It is a commercial pilot.

SK: Who will be your EPC on the new project? (Developers typically prepare projects with siting, permitting, securing off-takers and financing, but contract out EPC: Engineering, Procurement and Construction)

KS: We are having ongoing discussions with the usual suspects. The most aggressive bidders have been Chinese EPCs. For the heliostats, there is a lot of competition now. You can get very good designs, Spanish and German companies as well as some in the US and then you can get the EPC to give you performance guarantees. So we are we feel that there is enough experience in the industry now to have a bankable solution.

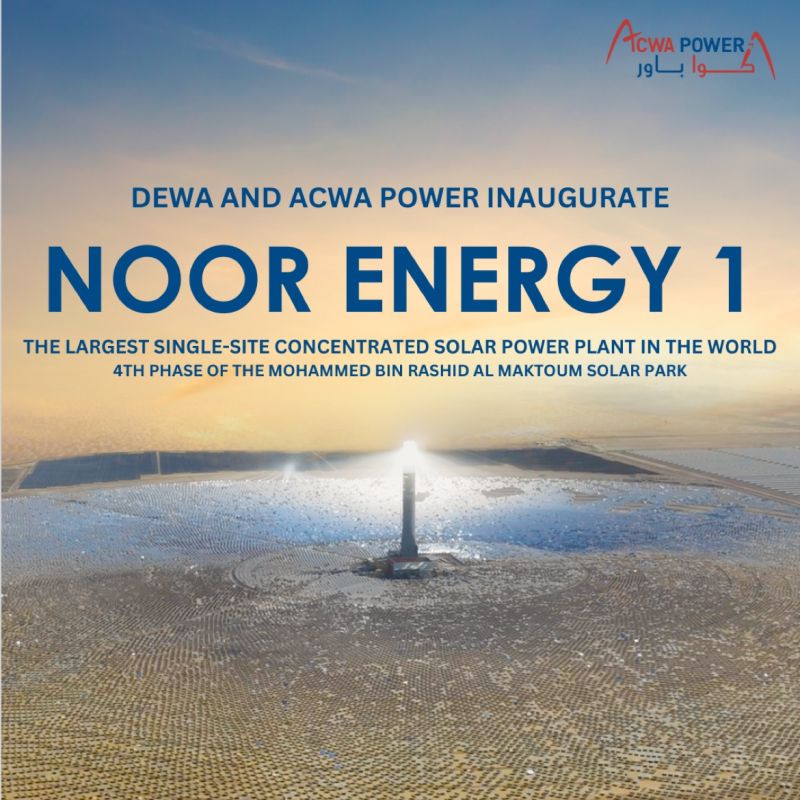

Chinese thermal energy construction giant SEPCO III building Noor II and III in Morocco

SK: Rumors are that a top Fortune 500 company is also interested in being the longterm project owner. What does that say about where CSP is today?

KS: I think the CSP industry is now really turning a corner in terms of its experience; its bankability, and in the performance of CSP plants.

Earlier in the project we were very concerned about costs and remaining competitive, but the entry of the Chinese into the CSP industry is – there may be a few hiccups at the beginning – but it’s now at a turning point.

We did a tour of the Chinese CSP players at the end of last year and one CEO took me aside and said: ‘You know, Kevin, we’re going to do the same thing to the CSP industry as we did to the global PV industry.’

They certainly are trying and that’s what the pilot program in China is all about. They had similar programs in PV to get that kick-started. So this is firmly in the Chinese five-year plan; to make CSP work.

[Ed: China’s investment into manufacturing PV led to an 80% drop in PV prices, according to E&E News’ Climate Wire)

SK: What is the biggest challenge?

KS: Market barriers in Europe. We would like the Europeans to open up their options for renewable energy to imports from outside of Europe.

The Moroccans have the same concern. At COP 22 The Moroccans announced a working group with Portugal, Spain, France and Germany to establish a framework for free trade in renewable energy. So the political support that we’re looking for is we are asking the Tunisian government to similarly support our efforts.

Our two target markets are Germany and France. And those remain the two most important markets for us. Small countries like Belgium and Luxembourg basically told us; if you have one of the big European countries backing this project we will join in.

SK: You mentioned that the project will generate $5 billion of overall in investment into Tunisia; what are some examples?

KS: What we expect, and that we have seen in other CSP projects is you can provide a lot of value-added domestically. All of the civil engineering and engineering services and supply and manufacture of heliostats, the towers, some of the boiler components; a lot of the things can be sourced locally.

There is also a manufacturing industry already geared up to international standards to supply the oil and gas fields here. There are cable manufacturers. And we are in discussion with a lot of them for them to retool to supply components for the solar fields, for example.

SEPCO III building Noor II and III in Morocco

SK: But would Tunisia’s supply chain for oil and gas want to retool for just one project? What would be the local benefit?

Well first of all that is why we ultimately plan such a large project to make it worth their while to retool. And the experience in Morocco shows that local industry is perfectly capable of stepping up and producing the components to international standards.

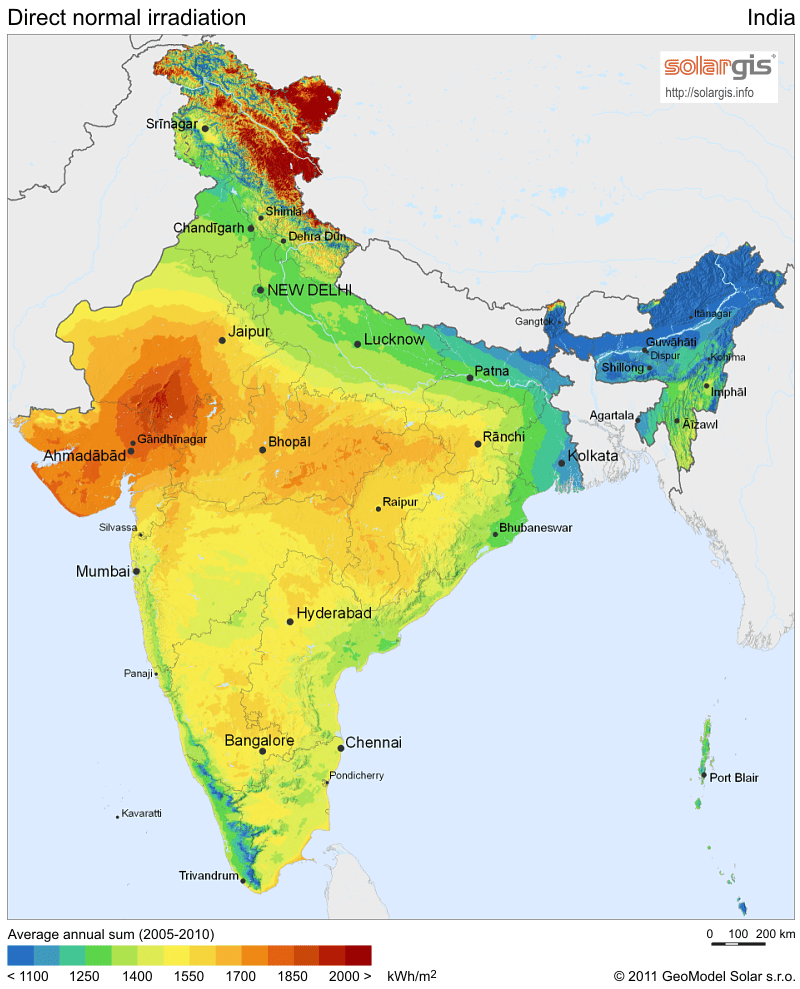

Tunisia is very much of a free market economy. When we started we really crisscrossed the country to see what would be the most suitable from a solar resource point of view, from a geological point of view, from an infrastructure point of view.

But also; to see where local people in the Tunisian private sector would welcome such a project. We’ve been careful since the beginning of this project, after the Desertec Initiative was accused of neocolonialism, we have been very sensitive to work in partnership with Tunisians in the Tunisian private sector.

That’s what we mean by investments; that we will as much as possible procure locally and establish local supply chains. The government would financially profit from the project through increase in tax revenues and royalties, and increased political stability arising from job creation in one of the regions of the country that has received very limited support for economic development to date.

In addition, Tunisia could then use this investment and development of expertise to develop its own CSP plants for domestic consumption to help with a future growing demand and its own low carbon objectives, at a cost competitive price. The impacts on the country and region will therefore be significant.