Minister of Energy Mmamoloko Kubayi’s announcement on Friday that Eskom will sign power purchase agreements (PPAs) with independent producers of renewable energy (IPPs) by October 28, might not be enough to prevent litigation against government for deviating from its own procurement process.

This follows after her department’s acclaimed Renewable Energy Independent Power Producer Procurement (REIPPP) Programme has stalled for more than two years as Eskom refused to sign PPAs with 37 IPPs.

The programme has, since its inception in 2011, resulted in investments totalling R200 billion, a quarter of which was from foreign sources. The 37 outstanding projects represent investment of R50 billion with 13 000 job opportunities during construction and 2 000 permanent jobs.

Kubayi’s announcement was limited to 26 IPPs appointed as preferred bidders in round 3.5 and 4 of the REIPPP programme. She stated that Eskom would only sign the agreements at a tariff not exceeding 77c/kWh.

The procurement rules provided for several bid rounds. The department of energy’s IPP unit managed the procurement process according to set rules and concluded an agreement with the preferred bidders which set the price at which Eskom would buy the energy and the term of the supply contract.

The IPP would still have to get the necessary approvals and generating licence from energy regulator Nersa and conclude a PPA with Eskom at the tariff agreed up on with the Department of Energy (DoE). Provided the IPP complies with what was agreed upon, it should be a given.

More than two years ago Eskom took a position that it would not sign further PPAs, citing the high cost agreed upon between the IPPs and the DoE. Eskom later indicated that it was prepared to sign agreements at a price not exceeding 62c/kWh.

Eskom now also sits with a surplus of generation capacity, which is a further reason for its reluctance.

Kubayi on Friday announced the outcome of work by a technical team and engagements between the DoE, Department of Public enterprises, National Treasury, Eskom and the DoE’s IPP office.

She explained that the current Eskom supply surplus is expected to last until 2021 and since the projects would only come into commercial operation around that time, it would not really exacerbate the over-supply.

Price is however another matter

While Eskom has moved from 62c/kWh, only some of the preferred bidders might be able to contract at the new ceiling of 77c/kWh.

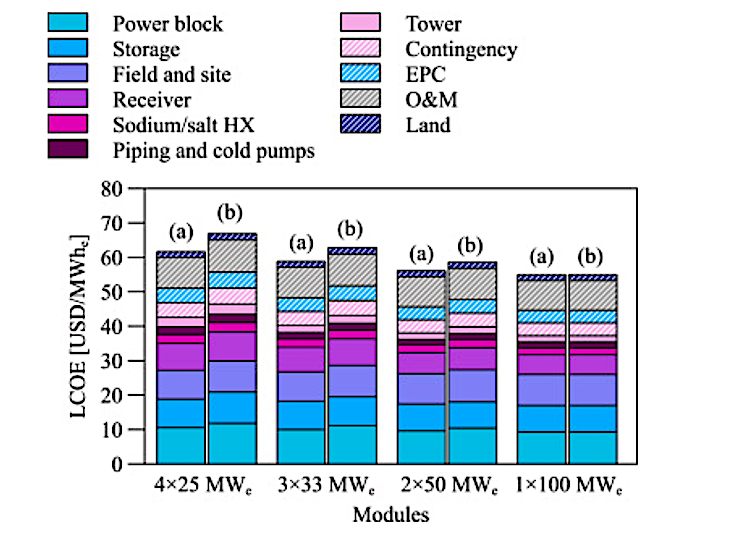

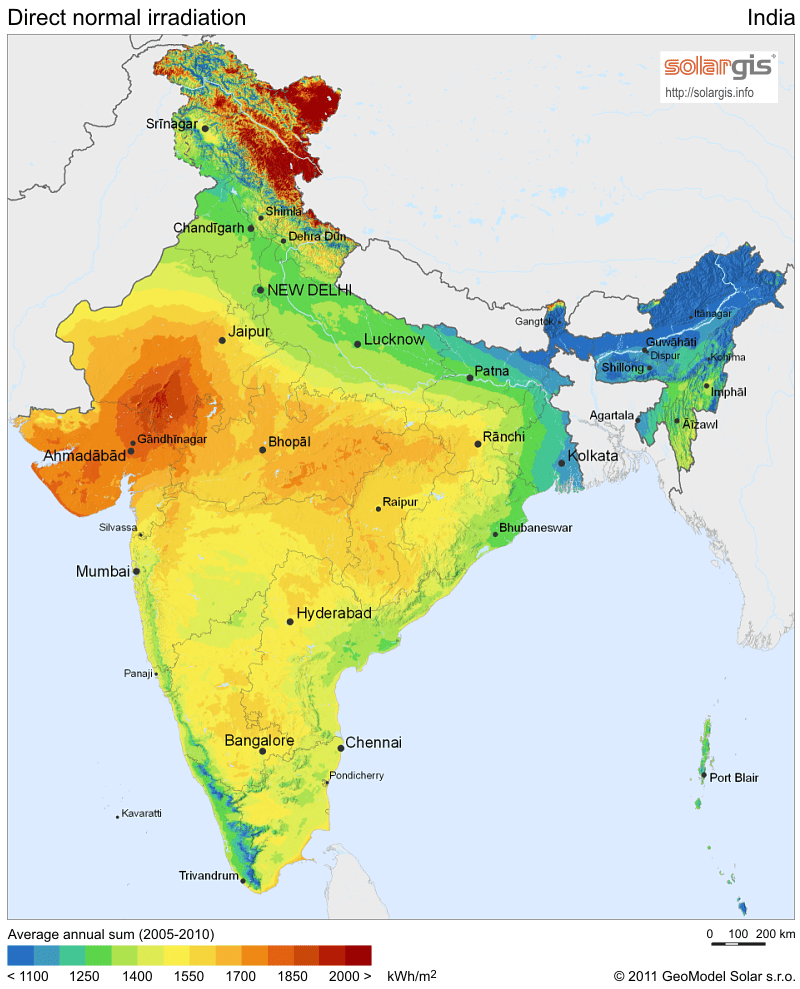

According to Mike Levington, director of Kabi Solar, the average price of wind energy in bid round 4 was 75c/kWh and that of solar photovoltaic (PV) 91c/kWh. These were the dominant technologies in that round.

It is therefore clear that Eskom’s 62c/kWh was a total no-go, but even the 77c/kWh might be a very hard sell to some bidders.

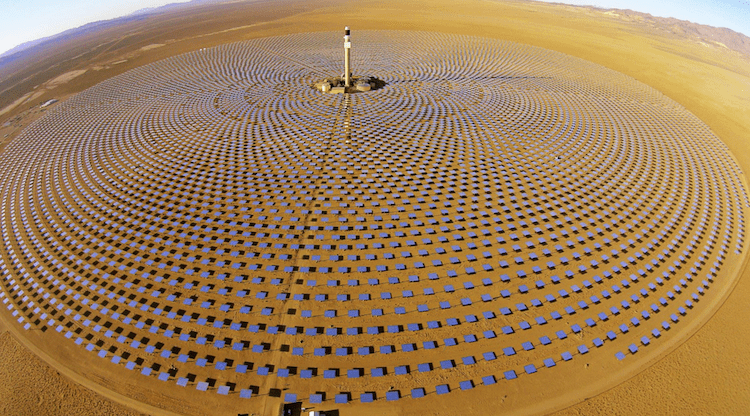

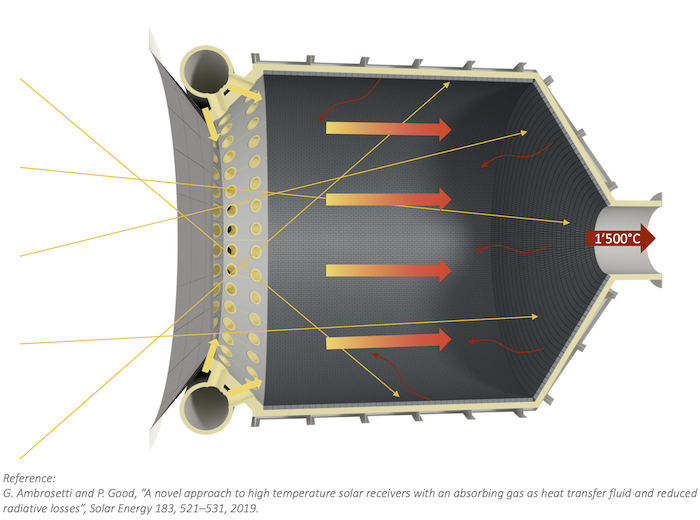

Round 3.5, says Levington, focused on concentrated solar power (CSP) as technology and there is no way it could deliver at 77c/kWh.

In fact, in the expedited round, which Kubayi has not committed to, wind and solar costs averaged around a lower 62c/kWh and CSP came in at R1.25/kWh.

It is clear that Kubayi realises that the deal she announced on Friday would be a hard sell. The South African Renewable Energy Council (SAREC) earlier obtained a legal opinion supporting its contention that government is not entitled to renegotiate that tariffs the DoE already agreed upon with bidders.

Kubayi made an undertaking to “meet with all IPPs participants in all bid windows, to discuss issues of concerns from IPPs and for government to give feedback on concerns before the date of signing”.

She has her job cut out for her to convince bidders to reduce their prices rather than proceed with litigation that seems to be a sure thing.

Speaking on the basis of anonymity an executive of several renewable energy projects told Moneyweb on Friday his company would have to go through the numbers before deciding on the way forward.

He said they already put their best foot forward in order to be included among the preferred bidders. To be able to reduce their price, they would have to see some reduction from their funders, which he doubts will be forthcoming.

He questions the basis for a tariff of 77c/kWh and furthermore that the same tariff is applied across all technologies.

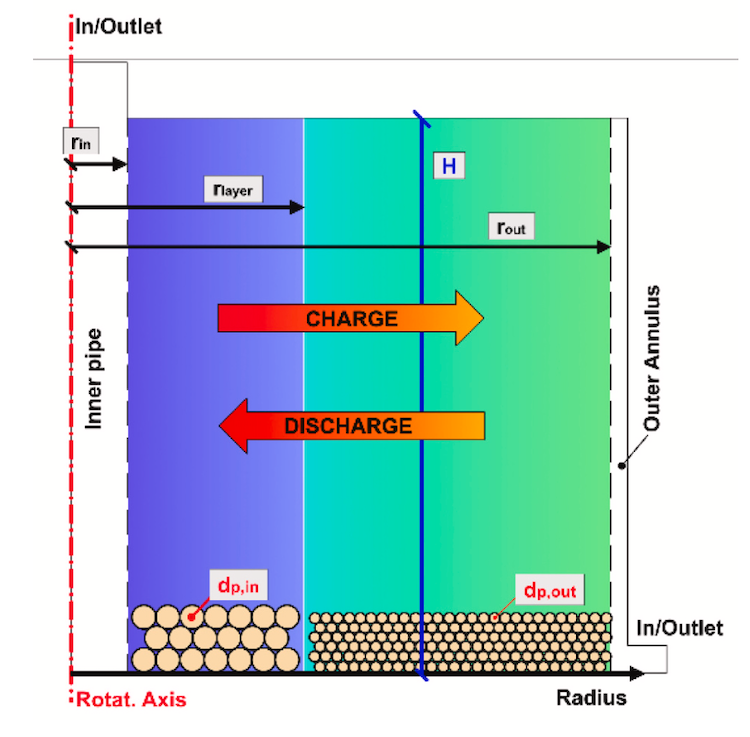

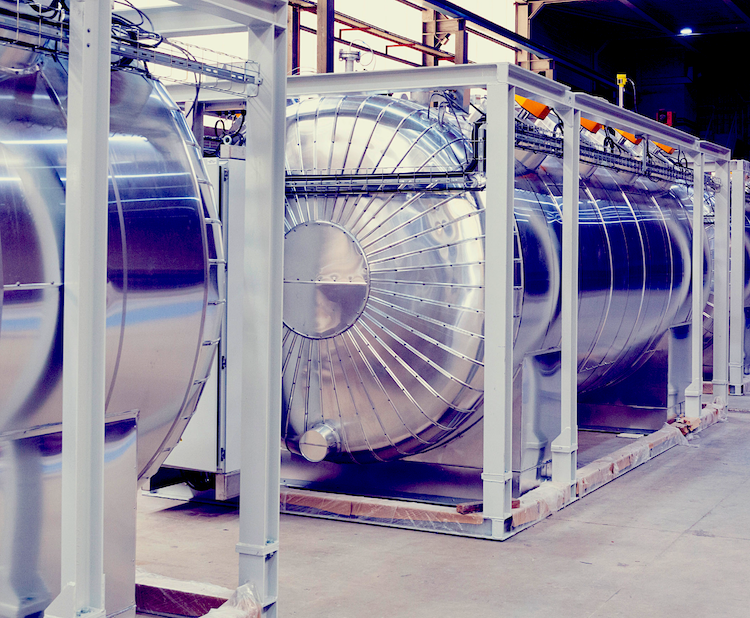

At that tariff government would in effect be excluding CSP, he says. He says that would be ignoring that CSP is combined with energy storage results in much more efficient renewable energy plants that can supply energy to the grid in the evening peak after the sun has set.

There seems to be a lack of understanding of the value of the quality of supply from CSP, he says.

He said the mere fact that government insists on renegotiating deals is of great concern and could impact future investment.

Kubayi said: “All future programmes to be put on hold until a proper review is done and to allow the IEP (Integrated Energy Plan) and IRP (Integrated Resource Plan) to be concluded that will give us indication of the capacity we need.”

These plans are expected to be finalised by February next year only, leaving investors in other renewable projects as well as gas and coal IPPs hanging.

Source: https://www.moneyweb.co.za/news/south-africa/signing-renewable-ipps-by-october-not-that-simple/