Latest CSP in Development: 2023

Sener Solgest-1 110 MW trough CSP

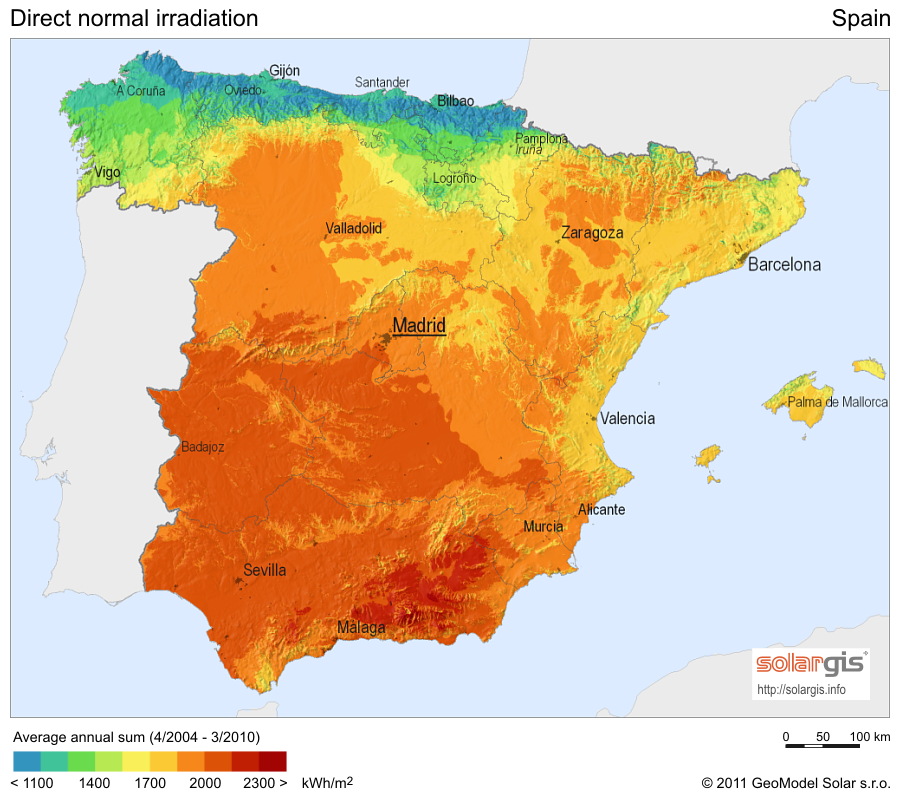

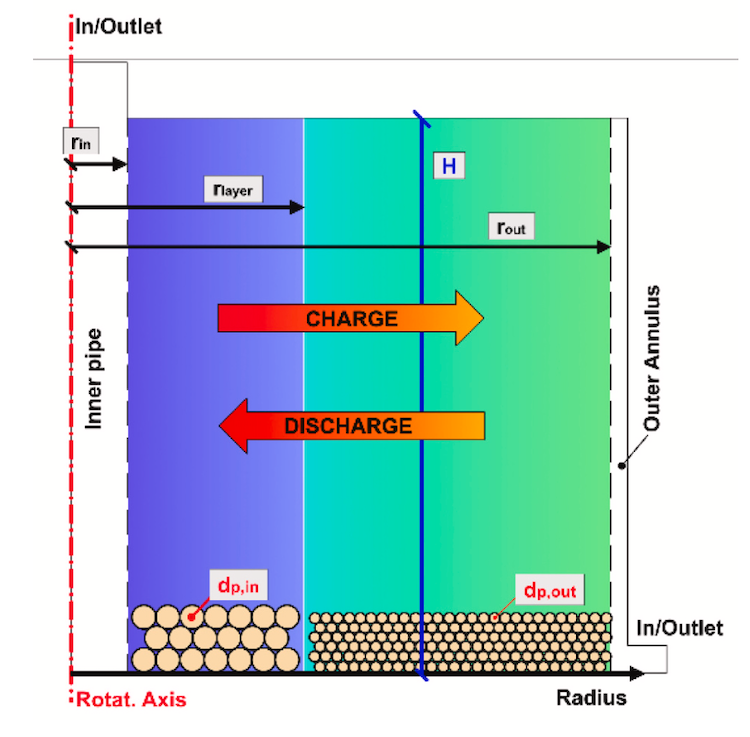

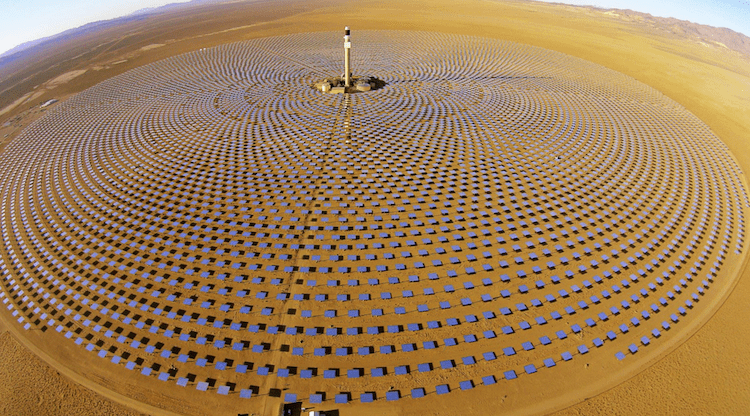

110 MW of new Spanish CSP is expected to start construction by year-end, 2023. Sener has secured permission to build near their iconic tower CSP plant near Seville, Gemasolar, with 15 hours of daily storage. Like Gemasolar, Solgest-1 will include overnight thermal energy storage; 1,900MWh daily.

Latest online: 2013

from the first round of CSP in Spain that culminated with 2.3 GW: 150 MW Termosol I, II, III, trough CSP, with 9 hours of storage: in operation since

Total CSP in Operation in Spain: 2.3 GW as of 2017

Earliest online: Andasol I,II, III: 150 MW CSP trough project with 7.5 hours of storage; in operation since 2008

Spain pioneered the feed-in tariff and within the five-year period from 2008, built 2.3 GW of CSP, the first in Europe and 2 GW more than the US at that time. As of 2017, 50 CSP plants with an aggregate capacity of 2.3 GW have been in operation since 2013. Forty five of these employ parabolic trough technology, three; totalling 50 MW, employ power tower technology and 2 plants, totalling 31.4 MW, employing linear Fresnel technology.

Thermal energy storage was included from the very earliest projects, with Andasol, the first CSP project in Europe, featuring 7.5 hours of storage, and Termasol (Spain’s final project completed before the 2012 renewable energy moratorium that has halted CSP development temporarily) included 9 hours of storage.

CSP History

In September 2002, Spain was the first European country to introduce a “feed-in tariff” funding system for solar thermal power. This funding system granted a premium on top of the electricity pool price of 12 € cents for each kWh output of a solar thermal plant between 100 kW and 50 MW of capacity, which could be changed every four years. But this amount proved not bankable nor did it cover the cost and risks to make the first projects feasible.

The Royal Decree 436/2004 introduced two alternative remuneration options for new CSP installed capacity. Solar thermal electricity generators who sell their production to a distributor receive as fixed tariff 300% of the reference price (7.2 € cents/kWh) during the first 25 years and 240% afterwards.

Solar thermal electricity generators who sell their electricity on the free market receive the negotiated market price of electricity, a premium of 250% of the reference price during the first 25 years, 200% afterwards, and an incentive of 10%.

This made solar thermal power projects, for the first time since the vintage Standard Offers of California in the late eighties, bankable and attractive for investors.

In May 2007, these “feed-in tariff” regulations are refined with the Royal Decree 661 which improved both alternative remuneration options for CSP plants. Under the first option, solar thermal electricity generators receive a fixed tariff of 27 € cents/kWh during the first 25 years and 21.5 € cents/kWh thereafter.

Under the second option, solar thermal electricity generators receive a premium of 25.4 € cents/kWh during the first 25 years and 20.3 € cents/kWh thereafter as a complement to the electricity market price. The tariff is increased yearly with the CPI minus one percent point. In order to grant dispatchability and firm capacity 12-15% natural gas backup is allowed.

The first commercial plant commissioned in Europe was the PS10 solar power tower developed by Abengoa Solar, which was also the first commercial plant in the world to use tower technology. PS10 is located in Sanlúcar la Mayor (Seville) and went online in mid-2007. By the end of 2009, 8 CSP plants had been commissioned with a total installed capacity of 283 MW.

In December 2009, the Spanish Ministry of Industry, Tourism and Trade published the retribution pre-assignment register for CSP facilities that met all the requirements established in Royal Decree 6/2009, 50 CSP projects totaling 2304 MW were included. According to the legislation, the registered plants could join the subsidy system in four phases from 2010 to the end of 2013.

In January 2012, the feed-in tariff (FiT) program implemented in 2007 was cancelled by the Government for new applicants, so that it would not be awarded to CSP plants beyond the 2304 MW approved in 2009 to enter into operation before 2014.

In 2012, the commercial development of new CSP plants was curtailed in the short term due to a moratorium through renewable subsidy retractions decreed by the Spanish Government. The last CSP project was completed in 2013.

In June 2013, a new law issued by the Spanish Government replaced the feed-in tariff by a Complementary Payment to be added to the Pool price of the electricity to provide the investors with a “reasonable profitability” of 7.5% over the lifetime of the project, and applicable to plants already in operation.

In May 2017, the Spanish Government lost the first of dozens of pending lawsuits seeking to overturn its de facto moratorium on renewable energy.

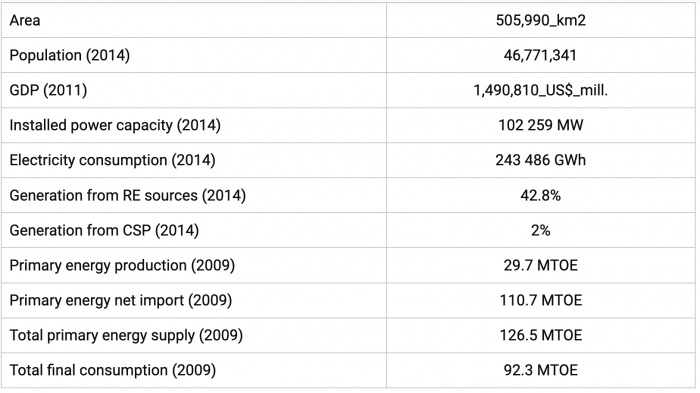

Country Data