“But even though the costs, the lifetime returns, and the speedy pay-back proved so competitive, during the three year study, Cuadros found that small and medium businesses were loathe to actually purchase and own novel technology.”

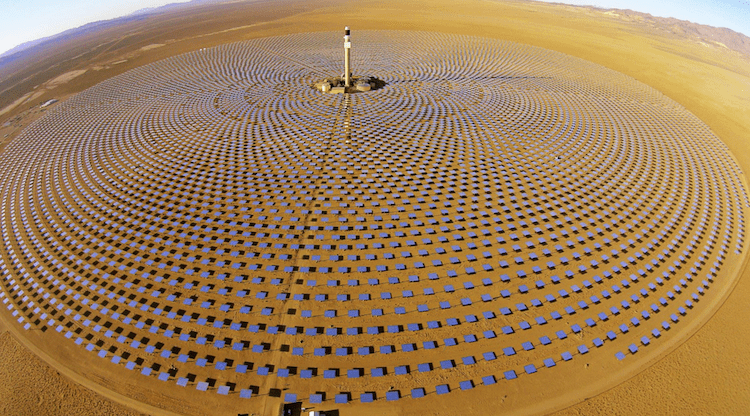

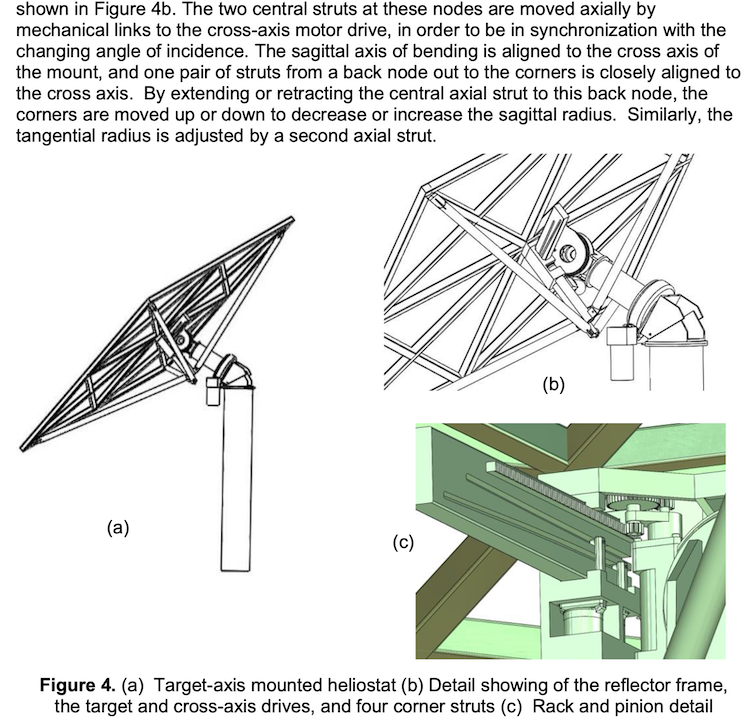

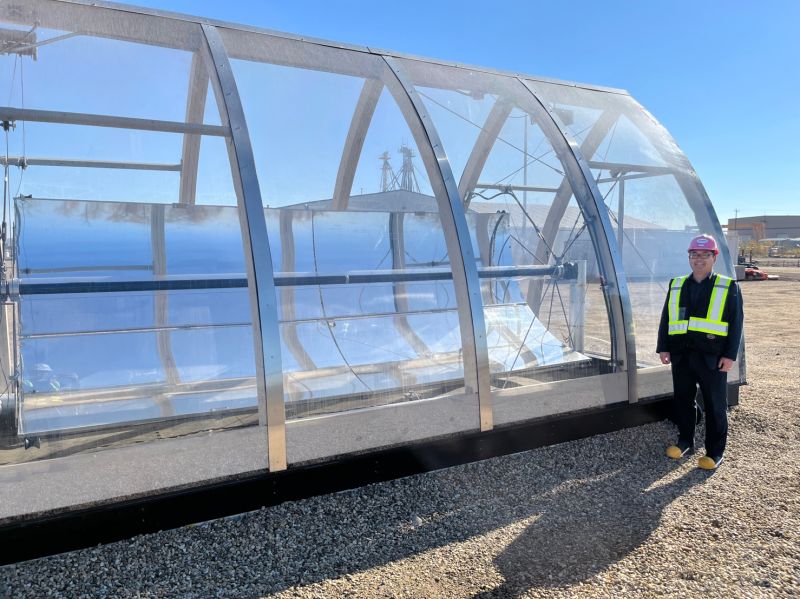

Glasspoint produces steam at 300ºC with a CSH setup of mirrors concentrating solar heat to boil water inside glasshouses for Oman’s oil industry IMAGE@Glasspointsolar

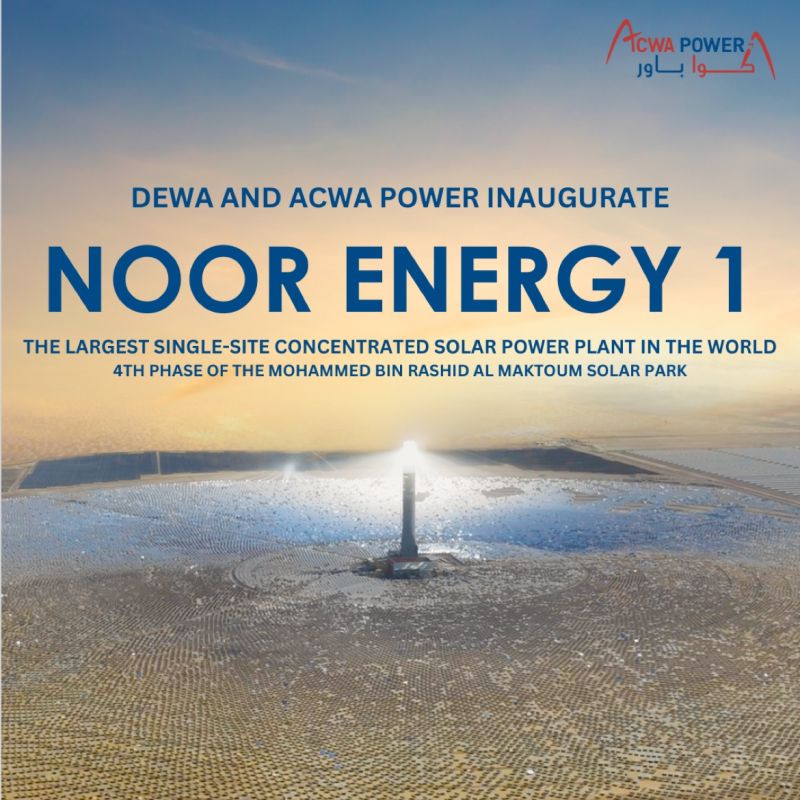

Only the deep pockets of the oil industry or governments have easily financed large-scale CSH; like Glasspoint’s 1 GW 300ºC solar steam for Oman’s oil, and Aalborg’s public district heating systems in Scandinavia.

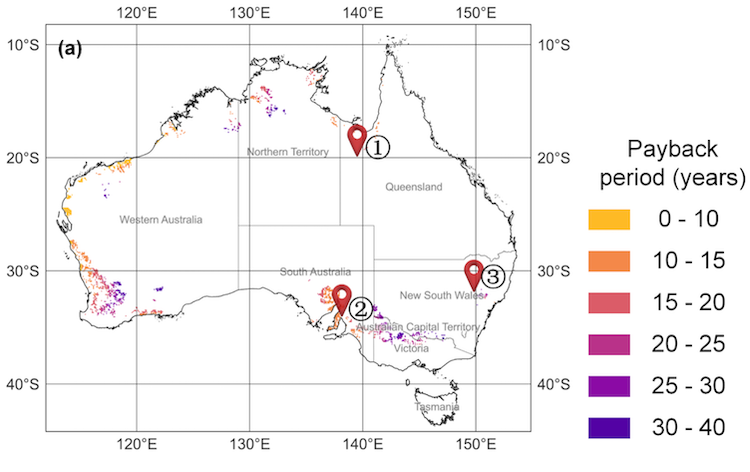

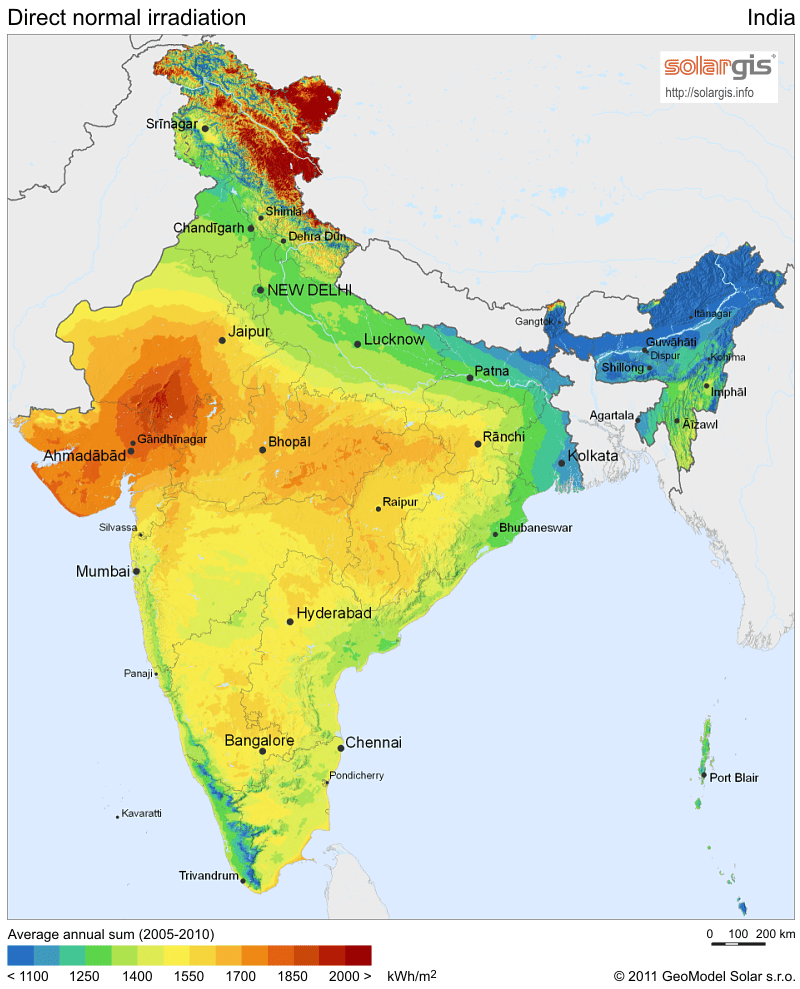

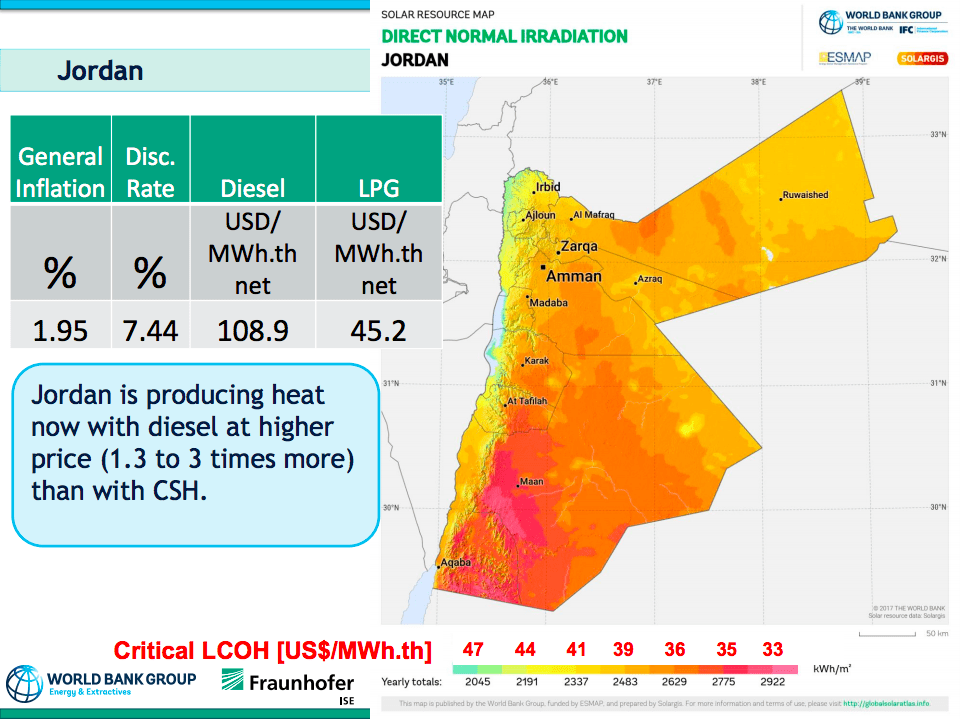

Which Middle East and North Africa (MENA) nations could decarbonize industrial heat with Concentrated Solar Heat (CSH) most cost-effectively?

World Bank energy consultant Elena Cuadros and Fraunhofer’s Pedro Horta supplied very detailed calculations showing where CSH could be substituted at a lower cost than fossil fuels by comparing CSH costs to specific fossil fuel costs currently used locally for industrial heat within the MENA region.

Their presentation was at the Concentrating Solar Heat (CSH) Workshop in Jordan, held jointly by the World Bank under its MENA Concentrating Solar Power Knowledge and Innovation Program (MENA CSP KIP) and Jordan’s Ministry of Environment.

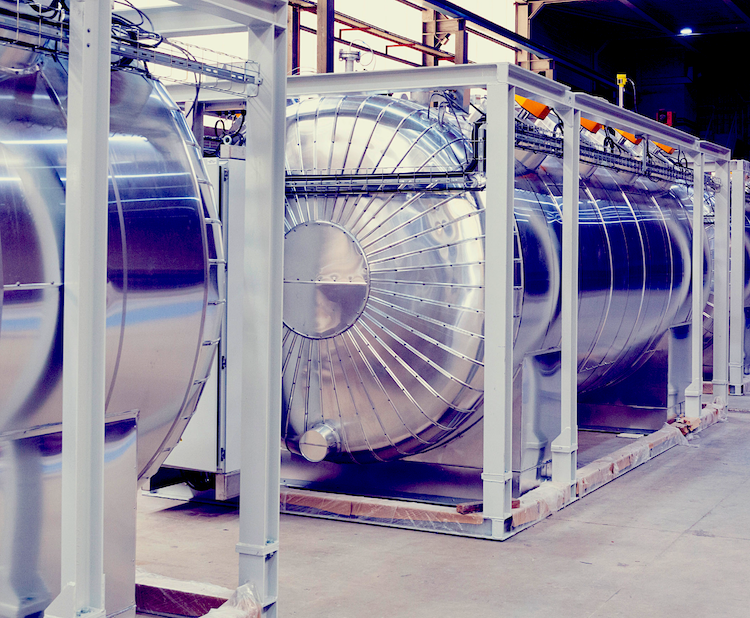

“CSH has been commercially proven for providing heat up to 400ºC for the pharmaceutical and textile sector, brick, paper, food processing and hospital uses. These industries are usually locally owned small and medium businesses and important sub-sectors. For these industries in the MENA region CSH is very promising.” Cuadros told SolarPACES.

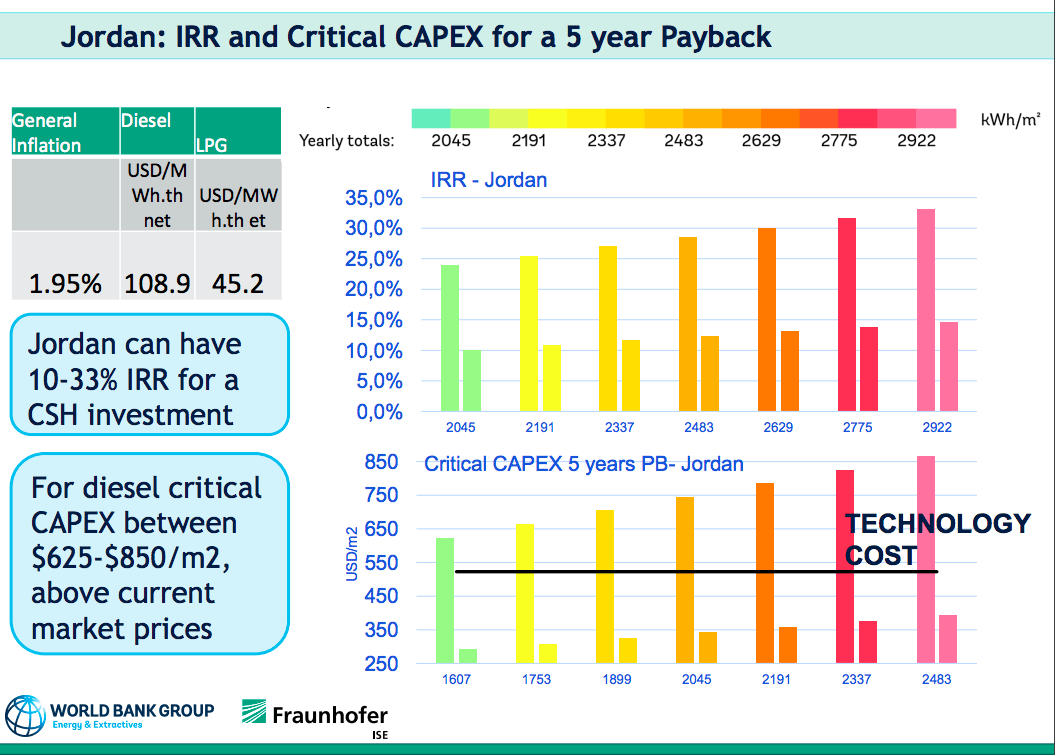

Cuadros and Horta found that CSH could have a 5-year payback now in MENA countries in locations with a good solar resource – where direct normal irradiance (DNI) is at least 2,250 kWh/m2.

For Jordan, Lebanon, Morocco or West Bank and Gaza we obtained a cost threshold higher than $525 for a 5-year pay-back period in locations with good solar resource, so CSH is already competitive with current market prices,” she said.

Tunisia and Egypt would also become competitive if they follow through on current plans to fully remove fossil fuel subsidies, she added: “Heavily subsidized fossil fuel prices are among the main factors hampering CSH deployment.”

Which MENA nations could decarbonize industrial heat with CSH most cost-effectively? IMAGE@Elena Cuadros Presentation CSP KIP

From the World Bank/Fraunhofer Presentation at CSP KIP on CSH in MENA region countries IMAGE@Elena Cuadros

World’s largest cooperative development bank

Cuadros teamed up with Senior Energy Specialist Jonathan Sinton, in the World Bank’s International Bank for Reconstruction and Development (IBRD), where the two are working on ways to decarbonize industrial heat in the MENA region.

“We think CSH holds great promise for virtually every country in the region,” said Sinton. “The more it’s deployed here, the more it becomes available for countries in other regions, like Southern Africa for example, that also have good DNI resources,”

Their message is “energy efficiency” to reduce fossil fuel consumption, he explained. “For us the model is energy efficiency financing. It’s a bit of a delicate dance, so we have to be a little bit measured in our approach. It is not our job to be heavily promoting particular technologies. It’s rather to make – or to help set – the playing field that would encourage the penetration of better, low carbon technologies, such as CSH.”

The deep pockets of the oil industry or governments have easily financed large-scale CSH; like Glasspoint’s 1 GW 300ºC solar steam for Oman’s oil, and Aalborg’s public district heating systems in Scandinavia.

Instead, with its poverty eradication mission, the IBRD focuses on small and medium businesses, and ensuring the business environment encourages their participation. For them, providing loan guarantees to facilitate financing, with some concessionality for local lenders would be a more practical approach.

“The rule for us in the IBRD at the World Bank is to help create the conditions for private sector activity as much as possible and less to lend directly to industries, except through the World Bank’s private sector arm, the International Finance Corporation,” explained Sinton.

“You would have some domestic agency like an energy service company. A project might have one or two or three on-lending banks that are points of contact for the project host, for the project developer, that provide the finance directly.”

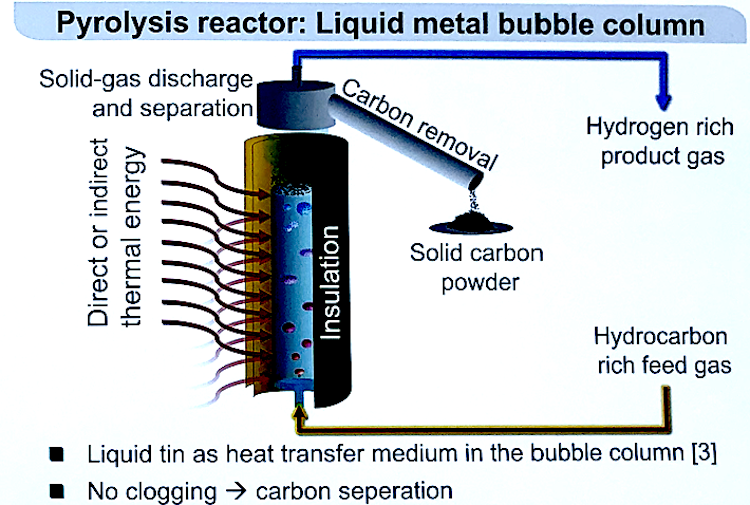

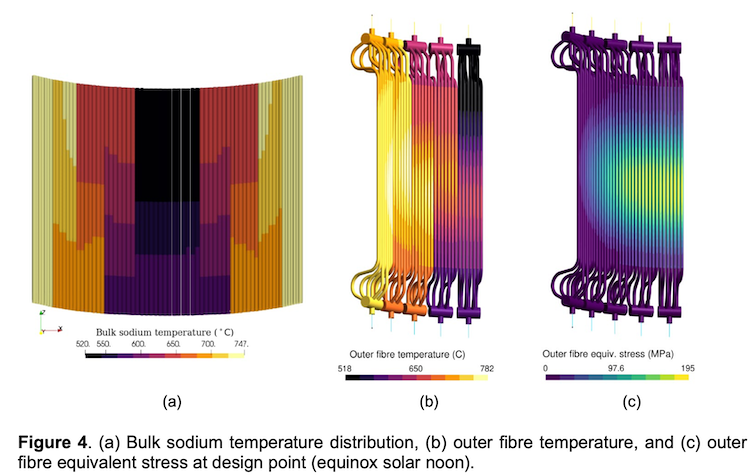

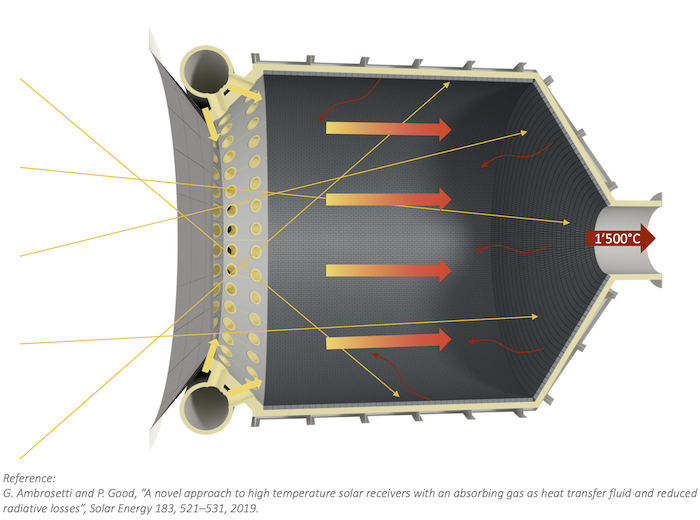

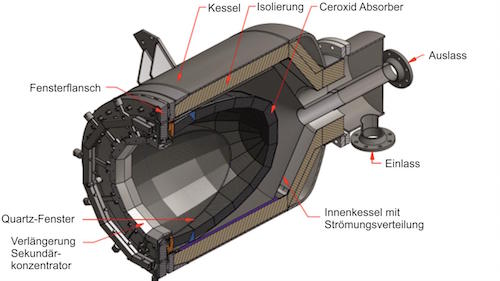

Cost calculations are based on solar collector size

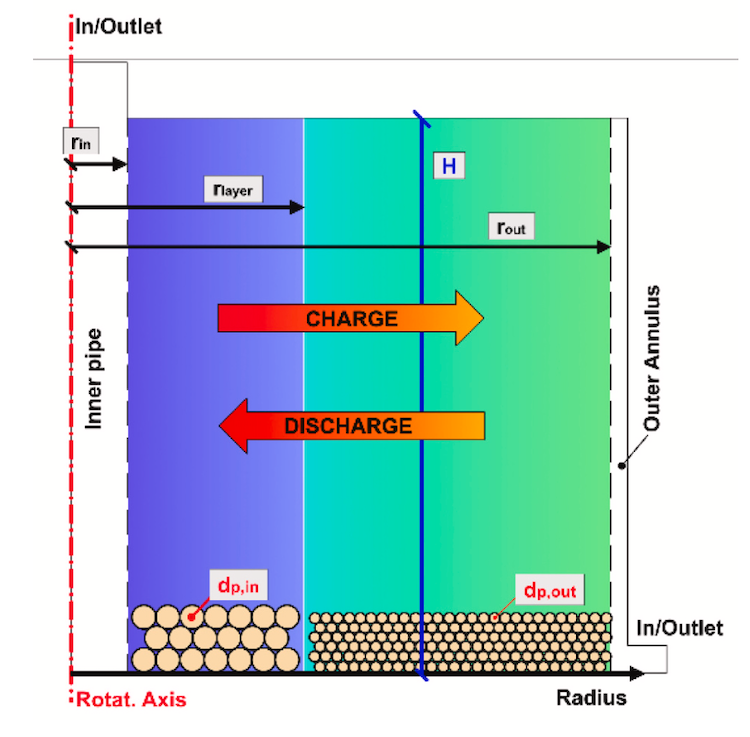

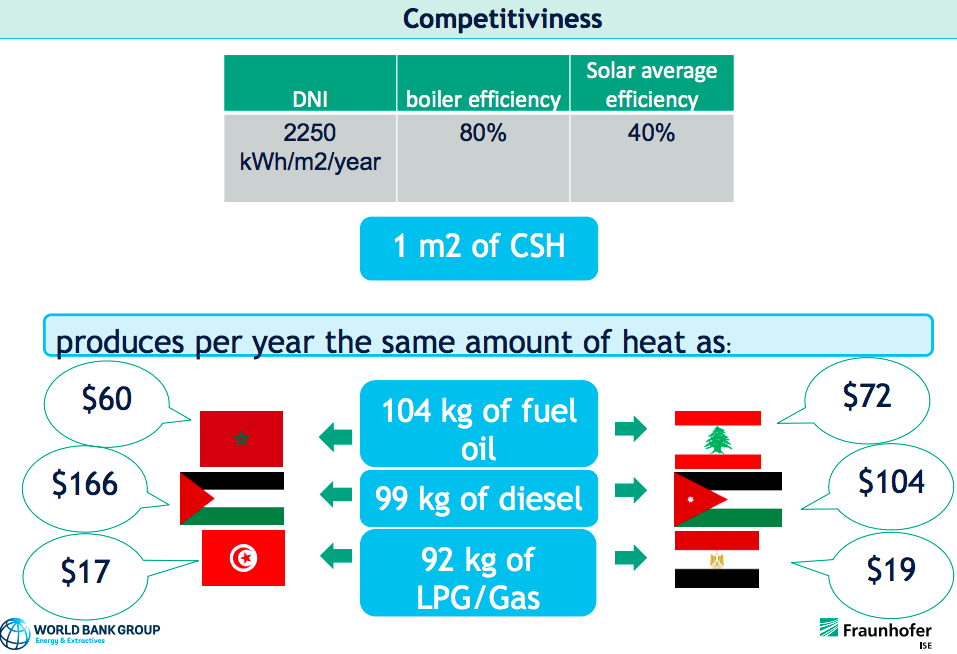

For medium temperature CSH, arrays of parabolic trough-shaped mirrored solar collectors concentrate solar radiation onto receivers (without a power block) to simply pipe direct heat.Cuadros said each square meter of collectors would produce in one year as much heat as about 92 kg of LPG or 99 kg of diesel, 3.4 MBtu.

Just as a solar farm with thousands of solar panels costs more than one with dozens, a CSH installation requiring more square meters of collectors costs more and generates more than one with fewer.So Cuadros’ estimates are based on the cost per square meter of solar collectors needed to produce the same amount of heat as the fossil fuel alternative.

The study’s common assumptions include a 20-year asset lifetime, 40% solar collector efficiency, 80% boiler efficiency and operation expenditure of 2% dis CAPEX.

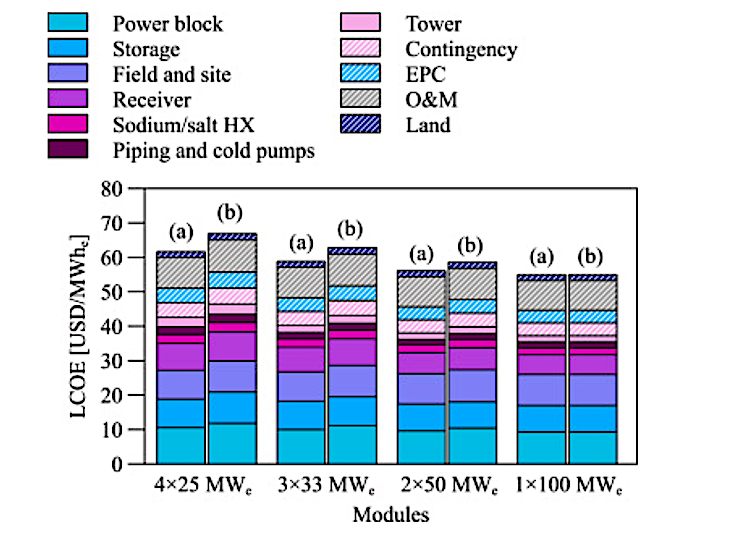

MENA region DNI is good, but varies among countries. Even within different regions within each country, DNI can be high or low. CSH investments amortize faster in better solar conditions resulting in a higher cost threshold. The “CSH cost threshold” or the maximum cost for the investment to be paid back within 5 years is derived from the sum of each country’s common costs and its variables – high or low DNI and high or low fuel costs.

Where CSH is cheaper than diesel or Liquified Petroleum Gas (LPG) in MENA

Of the two fuels, diesel would be the easiest to compete with. All but Tunisia and Egypt could decarbonize heat with solar cost-effectively already.

In the West Bank and Gaza, with the highest diesel prices in the region, CSH cost per square meter of collector could be as high as $1196 in high DNI regions and the solar option would still be competitive, (or could cost up to $753 in the country’s lowest DNI).

“I provide both figures because, depending on the local solar radiation conditions and for the same investment costs, a location with higher solar resource will present a higher energy yield,” Cuadros commented.

Morocco came next; its CSH cost threshold is $624 in low DNI or at $920 in high DNI regions. Jordan was next, at $624 or $867, Lebanon at $401 or $620, Tunisia at $354 or $594, and Egypt at $246 or $326.

Cheaper LPG impacted the CSH cost threshold. But with the highest LPG prices in the region, CSH cost per square meter of collector in Lebanon could be as high as $673 where the solar resource is good or $434 where it is lower. West Bank and Gaza was next with $660 or $425, Jordan with $393 or $292, Egypt at $216 or $169, and Tunisia, at $166 or $132.

“Current market prices are around $525 per square meter, but some CSH developers in emerging markets like China are offering very aggressive prices, half that or even lower,” she said.

Presentation IMAGE@Elena Cuadros