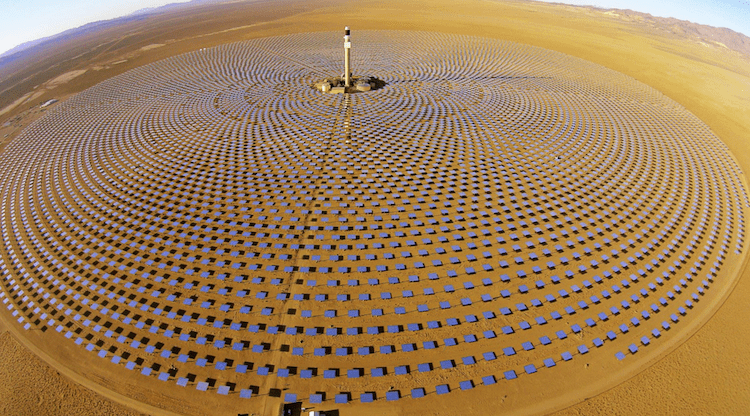

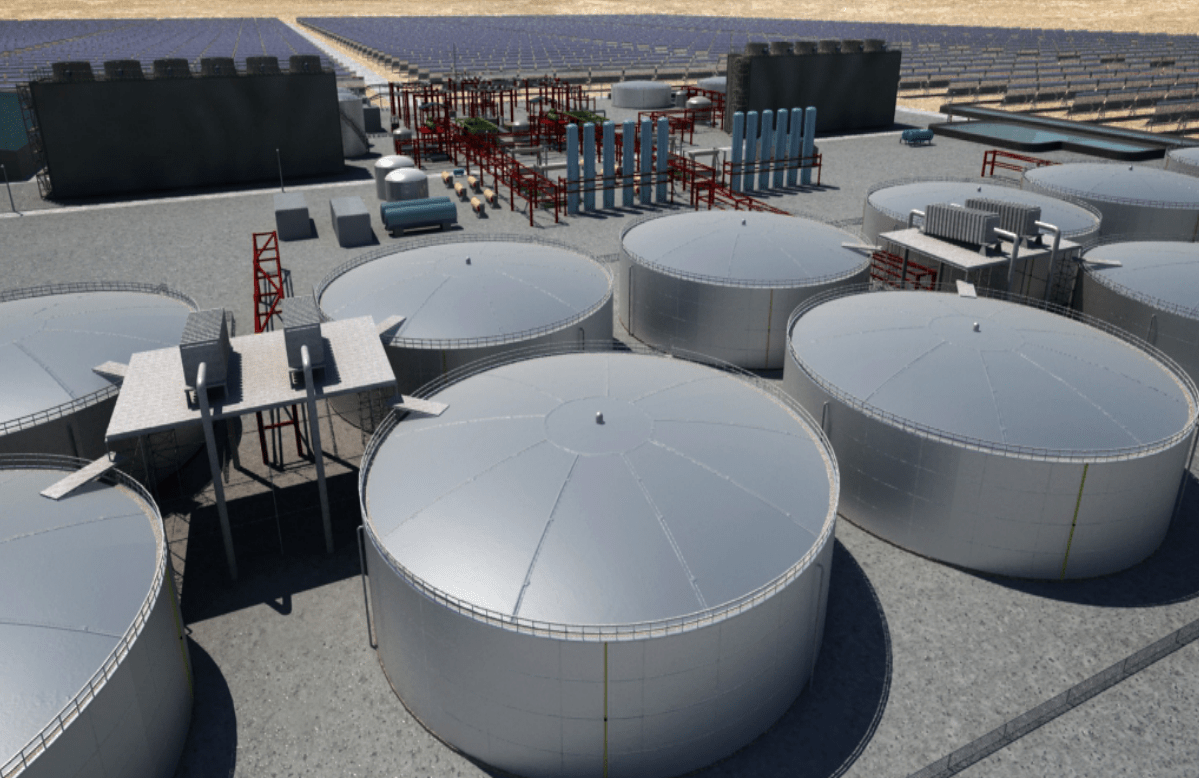

IMAGE@Abengoa Solar thermal energy storage tanks at the 280 MW Solana CSP+TES project in Arizona (Two storage tanks would fit in a football field)

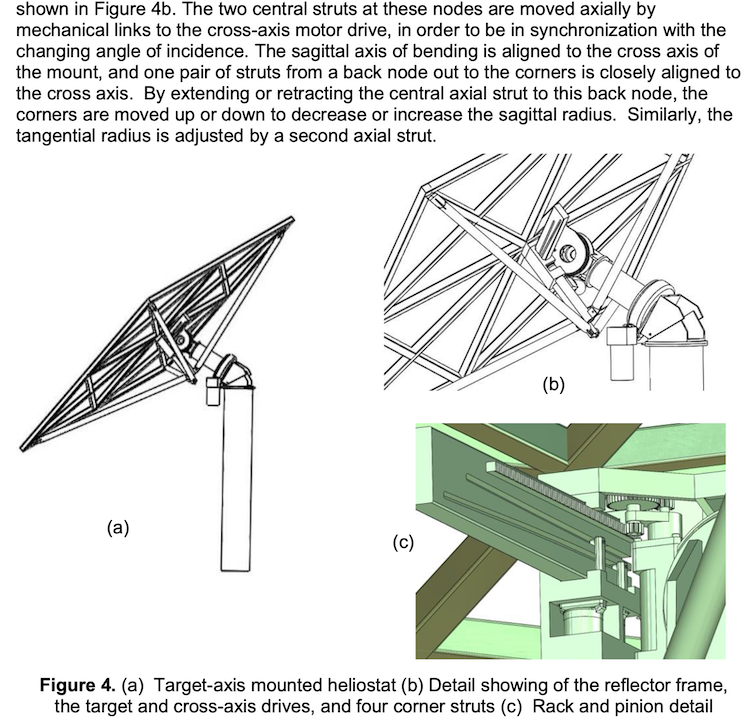

CSP+TES match a 100% clean grid “best fit” needs – flexibility, reliability, dispatchability, durability – but utilities don’t know how to procure them

It is common wisdom in the climate and clean energy world that the electric grid will need new storage resources to cover the “last mile” to get to 100% carbon-free electricity. These must be flexible, reliable, dispatchable and durable over the long term. Yet, despite more and more 100% carbon-free mandates, little is happening in policy to jumpstart markets to get there by deadline.

To remedy this lack; “the King of CSP” Fred Morse put together a comprehensive forum on Concentrating Solar Power (CSP) with thermal energy storage (CSP+TES) to help US stakeholders understand the role it could play.

Over a year in the making, the resulting forum; The Role of Concentrating Solar Power in the Evolving Energy Market in the Western U.S., held in California in February 2020, brought together over 50 western US utility representatives, grid operators, regulators and policymakers, with 20 international CSP experts, developers, consultants, owners and operators.

————————

SK – At the Department of Energy, you pioneered the solar energy program for Jimmy Carter, and most recently you were US Senior Advisor to Spanish CSP developer Abengoa. As a solar industry veteran, you understand policy issues from both sides. How did you ensure this real exchange of knowledge?

FM – I brought together the CEOs of the two largest grids in the West; ERCOT and CAISO, the CEO of the Western Energy Coordination Council, senior vice presidents of many of the western utilities, and representatives from several public utility commissions.

Each utility and grid operator speaker was asked to cover specific topics. The moderators met first with their panel speakers to make sure the session objectives were clear. And each CSP speaker was given guidance on which aspect of CSP plants they should cover.

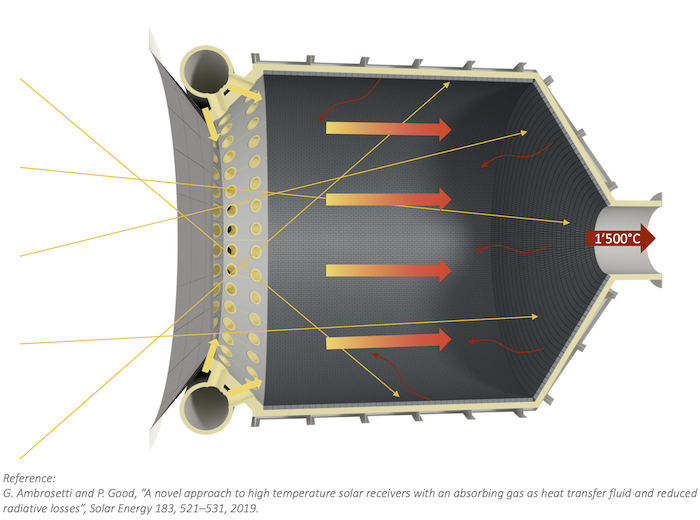

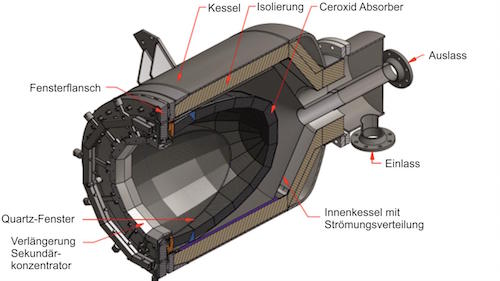

I wanted them to converge on the “aha!” moment – that the capabilities of CSP+TES align well with the evolving needs of utilities and grid operators. Already, and perhaps for the next decade, molten salt storage will likely be the lowest cost option for long-duration energy storage.

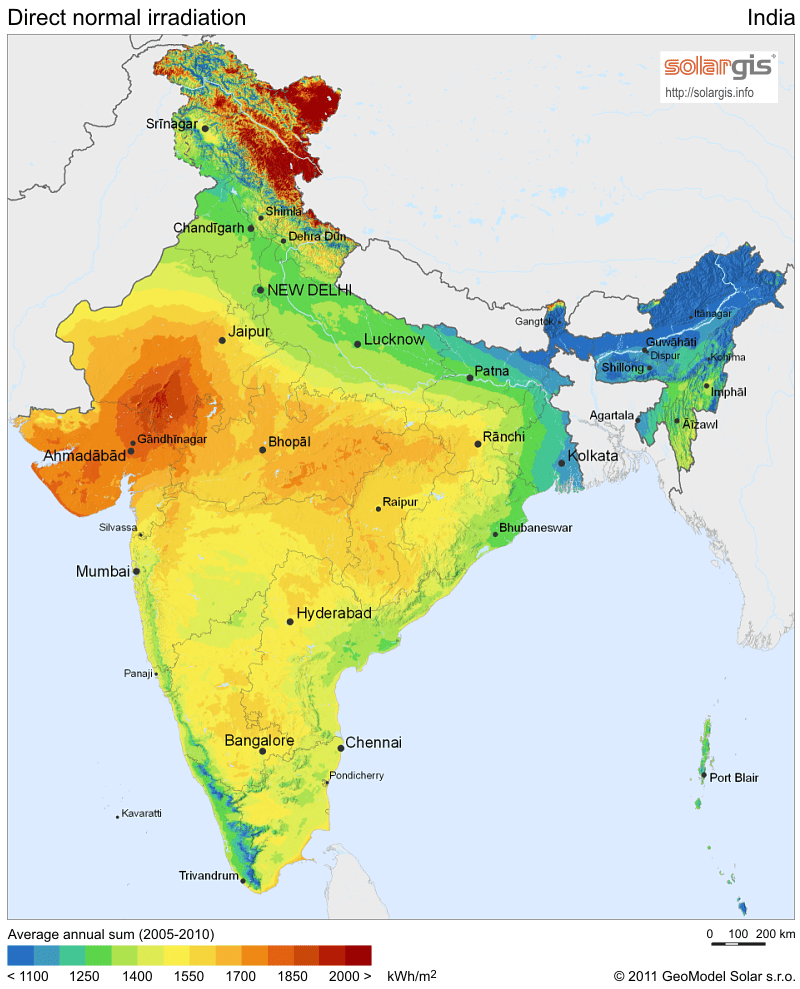

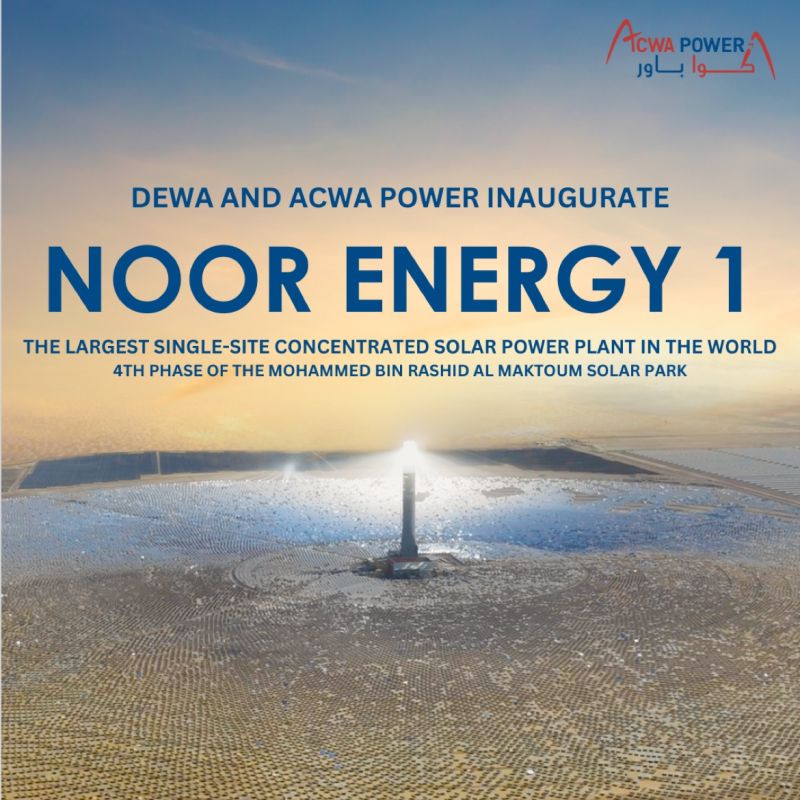

For example, Miguel Romero, VP of Energy Supply at SDG&E told the forum that 4-8 hours will not cut it – we need long-duration storage. In the United Arab Emirates, the Dubai Electricity and Water Authority (DEWA) issued a request for carbon free generation 24 hours a day, open to any technology – essentially saying; bid whatever you want.

I knew that the CEO of ACWA Power, Paddy Padmanathan found that it was too expensive to meet this request with PV and batteries, and instead proposed a hybrid; 250 MW PV and 700 MW CSP+TES. He won the bid at a record 7.3 cents/kWh.

SK – What were your conclusions?

FM – One was that while the capabilities of CSP+TES match the needs of the utilities and the grid operators, the flexibility, reliability, dispatchability, durability – all the “abilities” for best fit – but the utilities really don’t know how they are going to procure them.

A new procurement approach is needed because lowest cost is no longer the winning factor. Utilities want to buy CSP + TES but they don’t know how. They need to figure that out.

Of course, utilities’ “best fit” needs vary. Some might need the ability to operate 24 hours a day, or to achieve a certain ramp rate at a specific time, or flexibility in design, or the ability to hybridize with PV or with a small amount of natural gas or biogas.

Let’s consider the state of New Mexico. The Governor and the legislature decided that New Mexico’s electricity will be carbon free by 2045. I assume regulators there asked the utilities for their plan: How will you meet your demand as you phase out New Mexico’s large coal and natural gas plants. What would you use instead? All of the public regulatory commissions, including in California, are asking for a plan, for how you get to these new targets.

IMAGE@Abengoa 280 MW Solana – first utility-scale CSP+TES in the US

SK – So how can we change from “lowest cost” to a new “best fit” procurement in the US?

FM – One way might be for the regulated utilities to present a revised bid approach to their regulators who would have to approve it – that is no longer based on lowest cost. The public utilities might do the same with their Board of Directors.

Regulators might hold a hearing to find out how resources could be acquired that meet the evolving needs of the grid and the utility, where those who represent PV and batteries, wind, CSP+TES and others will make their case. Commissioners could ask about their capabilities; how fast can you ramp up and down; can you control voltage and regulate frequency; can you operate and follow demand 24 hours a day – and so on. And maybe during that hearing they would ask the utilities if they have any ideas on how to procure such capabilities.

Perhaps the Department of Energy could help develop a model request for proposal (RFP) and a model power purchase agreement (PPA) to satisfy this need, by including people familiar with utility bids and lawyers who negotiate PPAs.

And to help utilities accurately model CSP+TES dispatchability and flexibility of design – for example, from peaking, to 24-hour load following – we had somebody from DOE’s renewable energy laboratory, NREL, talk about modeling and to let them know that NREL could help them properly model CSP+TES if needed.

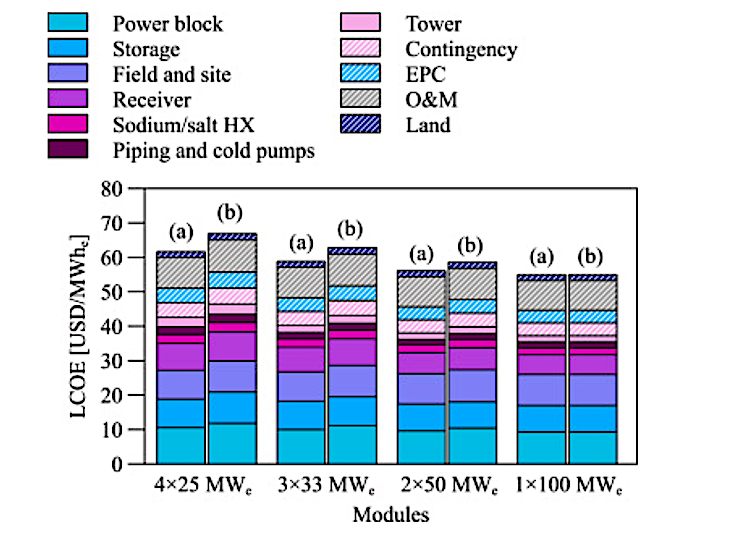

It’s clear that with the dramatic cost reductions occurring in CSP, as well as solar PV and wind – with and without storage, we will soon be operating our grids with almost all zero-marginal energy cost resources. At that point, basing merit order dispatch on fuel costs no longer makes sense.

We should create new dispatch priorities based on best fit values, such as lowest carbon emissions, or the marginal value of flexibility. Work is underway to devise these new dispatch algorithms.

SK – I was surprised to hear from LADWP that nobody’s even bidding CSP anymore. Why, do you think?

FM – I’ve not read LADWP’s procurement document, but maybe they looked for lowest cost renewables, rather than best fit. As soon as you have a meaningful RFP for something that CSP with storage could provide, bids will appear. I don’t think ACWA is interested in the US, but most of the companies now active globally will bid. If the market is large enough, I would expect some newcomers as well. And given the benefits of CSP/PV hybrids, if I were a PV company and making very little profit in today’s race to the bottom, maybe I’d team up with a CSP company.

I participated in the NREL Best Practices project which will soon issue a report that should help all new CSP plants come online with far fewer issues than earlier plants had. The US market will benefit from this knowledge. Furthermore, people with CSP expertise and knowledge are moving around, bringing their experience with them. When I went to visit the Noor I, II, and III projects in Morocco, I saw friends from Abengoa who now work for ACWA Power.

SK – Might unrealistic deadlines be an obstacle?

FM – Yes, scheduling is often an issue with power plants. Because both demand and resources can change quickly, utilities prefer plants that can be built quickly. Compared with PV, building a CSP plant is not quick. You have to design to meet utilities’ specific needs, find and control a suitable site, permit the plant on that site, arrange access to the transmission grid, and finance the plant (which often is quite complex).

And construction time is an issue. Barbara Lockwood, SVP of Public Policy at APS brought up construction time. She wondered if a better option is smaller plants that could be built faster. I believe that as more CSP+TES plants are built and as plants become standardized, this could happen.

SK – How about costs? Can longer PPA contracts like ACWA Power’s 35-year PPA with DEWA help?

FM – Yes, cost is an issue. A developer could spend tens of millions of dollars on these steps, before they even had a PPA. That is all money at risk. And yes, longer-term PPAs will get the price down. In a perfect world, longer PPAs are better than shorter ones, just as an ample construction schedule is better than an unrealistic one.

But let’s think about the utilities’ perspective. No utility wants a 35-year PPA. For them, shorter is better because they face uncertainty in demand and in future resource options and prices; 35 years is a long time horizon. Utilities don’t even like PPAs because they show up on their books as debt.

One way to get around this issue is the build, own, operate and transfer approach; BOOT. The developer agrees to ultimately transfer plant ownership to the utility. The CSP plant would then be an asset and could earn a return on its investment.

Another potential solution could be something more states are considering – performance-based regulation for utilities; where regulators establish performance metrics, improved grid reliability or reduced carbon emissions, and utilities earn a rate of return based on their accomplishment of those goals.

SK – They sound like great solutions. What’s your overall prescription to re-start a US CSP market, but this time; with storage?

FM – Assuming that utilities and regulators find an effective way to procure the needed services that CSP+TES could provide, a combination of state and federal policies are needed, at least at the beginning of the re-started market. States should continue sales and property tax exclusions and establish effective solar development zones. And the federal government should extend the 30% investment tax credit for as long as politically possible and make it a grant, continue the DOE loan guarantee program, and continue accelerated depreciation.

I like what MASEN did in Morocco. They identified a suitable area large enough for the capacity they needed; permitted that site and built the needed infrastructure, including transmission access. Then they said bid and build your CSP here. That reduces the cost to the developer and results in lower energy price. And this saves considerable time.

I would like to see a study done on MASEN’s approach for the US. That is one of the things I’m pushing for. Start by looking at the many areas that have already been identified by the Bureau of Land Management throughout the southwest – solar energy zones where solar power plants should be located. Perhaps some states could apply the MASEN approach to these areas.

And there is something new that is worth studying. Let’s explore a possible role for the Western Area Power Authority, WAPA, which built and owned the big hydro energy projects in the old days of big federal investment in energy. Maybe WAPA could have a role in purchasing and transmitting the output from solar power plants in those solar zones throughout the southwest.

US DOE: CSP Could Provide Needed Flexibility and Reliability to Grid

Climate Policy that Actually Works: How Morocco is Meeting its Clean Energy Goals

Morocco’s Ourazazate Noor III CSP Tower Exceeds Performance Targets